DIVERGENCE XAUUSD TRADING SETUPS SUMMARY

Classic Bearish - Characterized by a Higher High (HH) in XAUUSD price action coupled with a Lower High (LH) reading on the indicator, this suggests latent weakness in the prevailing market trend - a caution signaling a possible shift from an upward to a downward trajectory.

Classic Bullish (LL xauusd price, HL indicator): This configuration indicates underlying vulnerability in the current downtrend, signaling a possible shift from a downward market direction to an upward one.

Hidden Bearish - LH on XAUUSD gold price, HH indicator. It shows trend momentum. You spot it in pullbacks during downtrends.

Hidden Bullish - HL xauusd price, LL indicator. It shows the basic strength of a market trend. This happens mostly during pullbacks in an uptrend.

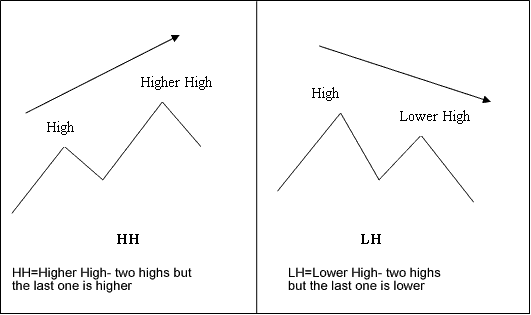

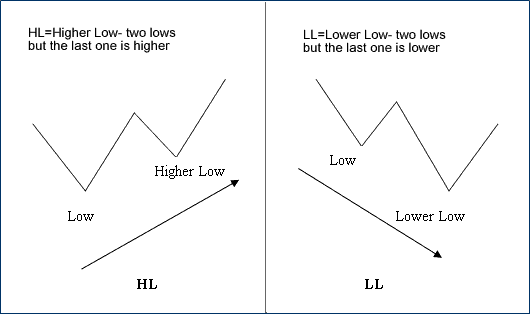

Illustrations of the divergence setup terms:

M shapes dealing with the price highs

M-shapes

W shapes dealing with price lows

W-shapes

These are the shapes to look for when using these setups.

One of the best indicator for this setup is the MACD - as a signal MACD divergence setup is a setup to open a trade. But as with any trading signal there are certain precautions and guidelines that have to be observed to make this signal a setup. Getting straight in to a trade as soon as you as the trader see this setup isn't the best strategy. This setup should be used in combination with another technical indicator to confirm the market direction of price trend. A good trading strategy to combine with is the Moving Average cross over trading system.

Be aware this setup on a smaller time frame isn't so significant. When divergence is seen on a 15 minute chart it may or might not be very crucial as when compared and analyzed to the 4 Hour chart timeframe on MT4 software.

If you see it on a 60-minute, 4-hour, or daily chart, start looking for other things to think about when the price might change because of the divergence.

This leads to a main tip for using the trade signal: On higher time frames, MACD divergence often signals a real price shift. But the key question is timing. Jumping into a XAUUSD trade right away on this setup isn't always smart.

Many investors and traders make mistakes by getting into the market too quickly when they see a MACD difference setting up. Often, the price of xauusd still has enough power to keep going in the current direction. The trader who started too early can only watch in disappointment as the price goes past their stop-loss order, kicking them out.

Relying solely on one trading setup without considering other elements reduces your chances of success. Gold traders aiming for better outcomes should also factor in additional indicators and market signals.

Other Factors to Consider in Gold Trading Setup

Support, Resistance, and Fib Levels on Gold Charts - Higher Timeframes

A substantial enhancement to the success rate of a trade can be achieved by examining the higher time-frame charts prior to executing an order based on signals from lower time-frames.

Observing higher time frames like hourly, 4-hour, or daily charts showing key resistance, support, or Fibonacci levels increases the likelihood of successful trades based on divergence on lower time frames.

2. Evaluating Reward to Risk Ratio: Equity management rules for gold trading

And finally, when scanning for divergence, it's very crucial that you enter the Gold trade correctly, so that as you have a good risk/reward ratio & only open trade transactions that have more profit potential than what you're risking. If you understand how to enter a transaction properly, you can gauge your risk reward before you open a trade. That way, you can only select to open orders that offer a favorable ratio.

In the end, if used the right way and with other indicators to back it up, divergence can lead to a lot of possible profit.

Get More Topics and Courses:

- Key Distinctions Between the Functionality of MT4 Software and the MT5 Trading Platform

- Executing Trades Based on an Upward Channel Pattern Observed in MetaTrader 4

- Listing Available Gold Indicators Found Within the Gold Charts Menu of the MT4 Software

- Applying RSI Swing Failure Setups in Both Upward and Downward Trends

- Technique for Drawing Downward Trend-lines and Channels on Gold Charts

- How do you set up a demo trading account?

- Various Platforms for XAU USD