Japanese Candles Patterns Gold Analysis

Japanese Candle Patterns TutorialBrief History

Candlesticks were created during the 18th century by Homma Munehisa, a prominent rice trader. They offer a concise overview of opening, high, low, and closing prices over a specified timeframe in trading.

He used them to forecast future prices as a famous rice trader. Munehisa took over the rice market. Then he shifted to the Tokyo Exchange. There he built vast wealth with this method. People say he pulled off more than 100 straight winning trades.

Types of charts

There are three types of charts used in XAU USD: Line, bar and candles.

Line - draws a continuous line connecting the closing prices of gold trading.

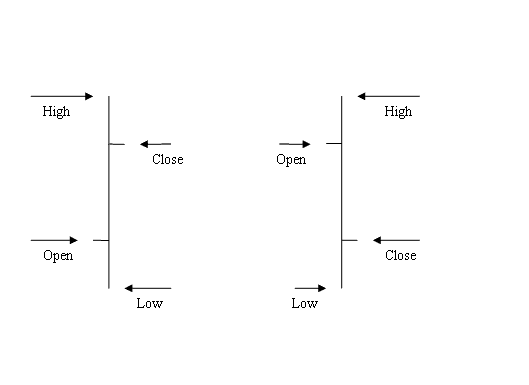

Bars show up as a row of OHCL bars. OHCL stands for Open, High, Low, and Close. On these gold charts, the opening price appears as a short horizontal line on the left of the bar, while the closing price is marked by a line on the right.

The biggest problem with a bar chart is that it doesn't look very nice or clear, so most traders choose not to use it.

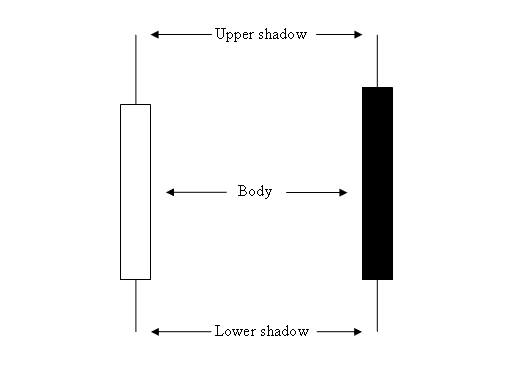

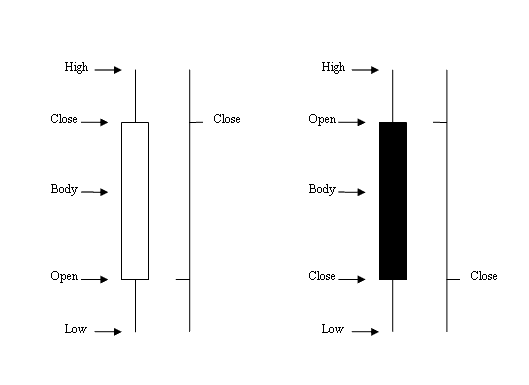

Candles: These utilize the identical price data as bar charts (opening price, high, low, and closing price). However, they are presented in a format that is visually more distinct and aesthetically pleasing, resembling a wax candle complete with wicks extending from both ends.

How to Analyze

The rectangle part is known as the body.

The high & low are referred to as shadows & drawn as poking lines.

The color may be either blue or red

- (Blue or Green Color) - Gold Prices moved up

- (Red Color) - Gold Prices went down

Most trading platforms, like MT4, use colors to show price direction. Green or blue means prices are moving up. Red means prices are dropping.

Candles Vs. Bar Chart

When utilizing candlestick representations, discerning whether the price advanced or retreated is visually simpler compared to interpreting traditional bar charts.

Japanese trading methods include many patterns for market analysis. Each has its own meaning. The most popular ones are listed below.

The above patterns make Japanese candlesticks popular among traders who use technical analysis, and that's why this kind of analysis is so widely used for studying the market. Analyzing these patterns in gold trading is the same as in stock trading.

Drawing These Charts in the MetaTrader 4 Platform

These are specific instructions that mandate the opening of a new bitcoin trade only after the bitcoin market reaches the exact price predetermined by the trader.

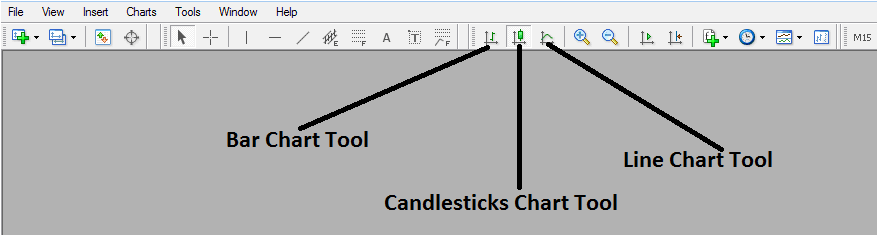

To view this tool bar in MT4 go to "View" Next to file on top left corner of the MT4 Platform, Click "View", Then Click "Tool-Bars", Then tick "Charts" Button. The above tool-bar will appear.

After the preceding toolbar appears, you, as the trader, can select the specific chart representation you wish to view. If bar chart format is preferred, click the corresponding bar tool button as indicated above: for a line chart, press the line tool button: and for candlestick format, click the "candles tool button."

Get More Courses:

- MT4 Margin Calculator

- How to Draw Fibonacci Extension Levels in Upwards XAUUSD Trend

- How to Add Ichimoku Kinko Hyo in Gold Chart

- How Do I Trade with Fibonacci Pullback Levels XAUUSD?

- How to Analyze/Interpret SMI Indicator Buy Forex Signal

- Decision-Making Process for Placing a Stop Loss Order on XAU USD Trades Based on Identified Resistance Levels

- Bollinger Bands XAUUSD Price Action in Range Bound Sideways Markets

- XAU/USD Strategy Trading Indicators & Writing Gold System Indicator Rules

- How Can I Read Bulls Power Technical Indicator?

- How Do I Do XAU/USD Position with Different XAUUSD Chart Time frames?