Gold Pivot Points

Pivot points serve as indicators created by floor traders in the commodities markets to identify potential turning points, or 'pivots'. These points help forecast levels where market sentiment may shift from bullish to bearish, acting as crucial markers for support and resistance levels.

These values are calculated as the average of the previous market session's high, low, and close prices:

XAU/USD Pivot Point = (High + Low + Close) / 3

Day traders leverage pivot points to establish entry, stop-loss, and profit-taking levels by predicting where other traders might make similar decisions.

A pivot-point is a xauusd price level of significance in trading analysis of a financial trading market that is used by Gold traders as a predictive indicator of price movement. It's calculated as an average/mean of significant xauusd prices (high, low and close) from the performance of a market in the prior trading period. If the gold prices in the following price period trade above the central point it's generally evaluated as a bullish sentiment, whereas if price below the central pivot point is seen as bearish.

The central pivot point helps calculate additional support and resistance levels above and below it. These levels are derived by adding or subtracting price differentials based on previous ranges.

A calculated pivot point, along with its corresponding support and resistance areas, frequently acts as a critical inflection point influencing future price direction in a market.

- In an up-trend, the pivot-point & the resistance zones may represent a ceiling level for the gold price. If price moving above this level the up trend is no longer sustainable & a trend reversal might occur.

- In a down-trend, a pivot-point & the support levels may represent a low for xauusd price level or a resistance to further decline.

The central pivot point can subsequently be utilized to derive the resistance and support levels with the ensuing calculations:

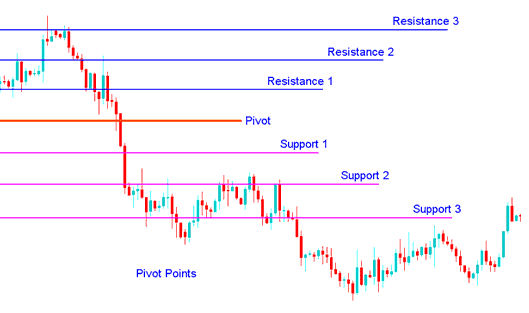

Pivot points feature a main level with three supports below and three resistances above. Floor traders on stock and futures markets first used them for quick daily trend views with simple math. Now they work well in gold and other markets too.

A key factor in their current popularity is their inherent nature as a 'leading' (or predictive) indicator, contrasting with indicators that merely lag behind market action. Calculating these pivot points for the upcoming (or current) trading day requires only the preceding day's high, low, and closing gold prices. The formulas used to derive the 24-hour cycle pivot points within this trading technical indicator are as follows:

The central pivot can then be utilized to determine support and resistance levels as follows:

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Pivot Points Support and Resistance Areas

Pivot Points as a XAUUSD tool

The pivot point line itself represents a level of highest resistance or support, depending on the over-all sentiment. If the gold market is direction-less ( range bound ) prices will often fluctuate greatly around this level until a xauusd price breakout develops. Prices above or below the central point indicates the overall sentiment as bullish or bearish respectively. This technical indicator is a leading indicator which provides market signals of potentially new highs or lows within a specified chart time-frame.

The congestion and ceiling levels derived from the central pivot point and the prior period's range may be employed as targets for concluding active trades, though they are seldom utilized as initial entry triggers. For example, in a scenario where the gold price is ascending and crosses above the pivot point, targeting the first or second resistance level is often a prudent objective for exiting a position, as the likelihood of encountered resistance and a subsequent price turn escalates significantly with proximity to each resistance zone.

In pivot point study, we usually see three levels above and below the center point. These come from the amount the price moved in the last trading time and are then added to the center for resistance levels and subtracted for support areas.

Pivot Points

Pivot levels possess versatility in their application: below are presented a few of the most conventional strategies or methods for their practical utilization:

XAU/USD Trend Direction: Combined Together with other analysis techniques/methods like overbought oversold oscillators, volatility measurements, etc., the central point may be helpful in determining/figuring out the overall trending market direction of the price. Trade Positions are only opened in the direction of the market trend. Buy trade transactions occur only when price is above the central point & sell xauusd trades occur only when price is below the central pivot point.

Gold Price Breakouts: In xauusd gold price breakouts, a bullish buy signal occurs and happens when price breaks out up through the center point or one of the resistance zones (generally Resistance Area 1). A short sell signal occurs and happens when the price breaks out downwards through the center point or one of the support levels (mostly Support Zone 1).

Gold Trend Reversals: In trend reversals, a buy signal occurs and happens when price moves towards a support level, gets very near to this point, touches it, or only moves slightly/a little through this level, and then reverses and starts heading and moving in the other direction.

To download Pivot Points Leves Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

After you download it, open it with the MQ4 Language MetaEditor. Then, compile the indicator by clicking the Compile Button, and it will be added to your MT4.

Note: After integrating it into your MT4 platform/software, the indicator comes with added lines labeled as Mid Points. To remove these extra lines, access the MQL4 Language Meta-Editor by pressing F4 and modify line 16 accordingly.

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Then Click Compile button again, & it will then appear and be shown as depicted on www.tradegoldtrading.com web site.

Study More Courses:

- How do I use the MetaTrader 4 app on Android?

- Keltner Bands indicator for XAUUSD

- Description of Technical Analysis TTF Buy Signals

- How do you add XAUUSD orders in MT4 charts?

- The Best Way to Learn Gold Trading

- How Do You Pick the Best XAU USD System to Trade XAUUSD?

- Dark Cloud Cover: The Bearish Candlestick Pattern

- Looking for the best XAU/USD trading platforms? Here's a quick review of desktop, WebTrader, and mobile options.

- Techniques for Trading and Managing an Upwards Channel on the MT5 Platform?

- How Do You Understand the MT5 Trading Software MetaTrader 5 User Guide?