Trading Identify a Candle Pattern

To identify and spot a candlesticks setup you will need to first learn about the various candlesticks patterns & learn under which setup these patterns form on the gold chart & what gold signal is derived & generated by each of these candles patterns.

Among the various popular candles patterns that every gold trader should know are:

Doji Candlesticks

This is a candle pattern with same opening & closing price. There are different types of doji candlesticks setup that form on Gold charts.

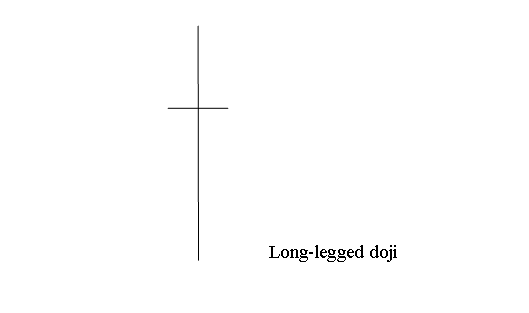

following illustrations describe different patterns of the doji candle:

Long legged doji candle pattern has long upper and lower shadows with the opening and closing price at the mid. When Long-legged doji pops and shows up on a chart it demonstrates indecision between the Gold traders, buyers & sellers.

Below is example screen shot screenshot of the Long Legged Doji candlesticks setup

Doji Pattern - Doji Gold Candlesticks - How to Identify a Candle Pattern

Doji Pattern - Doji Gold Candles

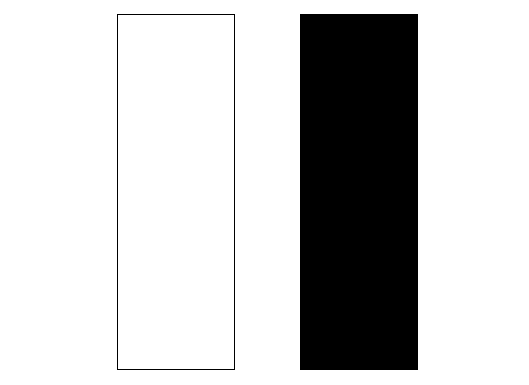

Marubozu Candlesticks

Marubozu candle-stick pattern are long candles which have no upper or lower shadows, Like illustrated below.

Marubozu Candle - Marubozu Gold Candlesticks - How to Identify a Candle Pattern

Marubozu gold candle-stick pattern are continuing candle patterns that show price is going to continue in the same direction of the marubozu candlestick. The marubozu candlesticks setup can be white/blue or black/red depending on the direction of price trend.

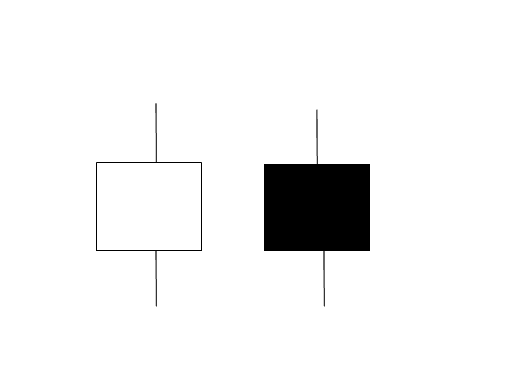

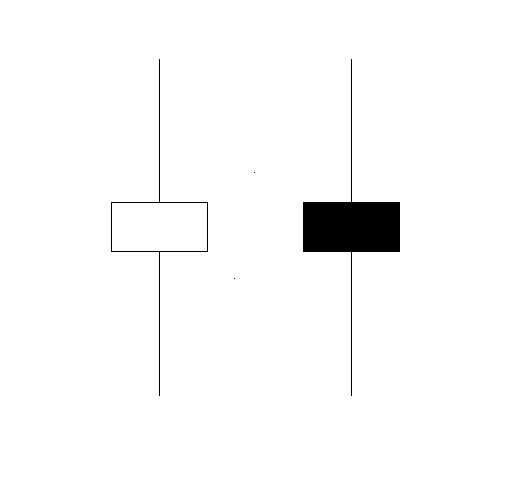

Spinning Tops Candlesticks Gold Candlesticks

Spinning tops gold candle-stick setup pattern have small body with long upper and lower shadows. These spinning tops candlesticks patterns are referred to by this term because these candles patterns are similar to a spinning top on a match-stick.

The upper and lower shadows of the spinning tops candles set-up are longer than the body. The examples shown and explained below shows the spinning tops candle pattern. You can look for the pattern in your MetaTrader 4 Platform Software xau/usd charts. The examples illustrated & illustrated below shows a screen-shot to help the Gold traders when it comes to learning and understanding these gold candle-stick pattern.

How Do I Read Gold Candlestick Charts - Spinning Tops Gold Candlesticks - How to Identify a Candle Pattern

Color of the spinning tops candle candlesticks setup isn't very important, this pattern show the indecision between the buyers and sellers in the Gold market. When these chart patterns appear at the top of a trend or at the bottom of the gold trend it may trading signal that the trend is coming to an end and it may soon reverse and begin and start & begin going the other direction. However, it is better to wait for additional confirmation signals that the direction of a market has turned and reversed before trading the trading signal from this gold candle pattern formation.

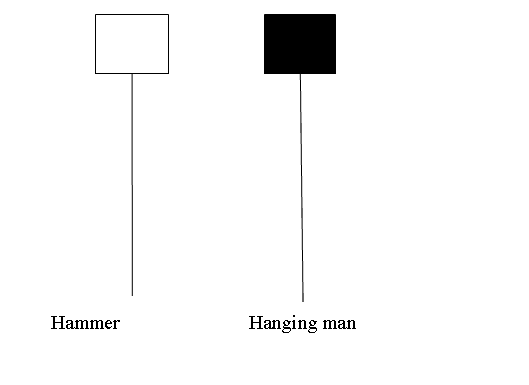

Hammer Candlestick Pattern and Hanging Man Candles

Hammer Candle Pattern and Hanging Man Candlestick Pattern candles look alike & similar but hammer is bullish price reversal candle pattern and hanging man is a bearish price reversal candle pattern.

Hammer Candle Pattern and Hanging Man Candlestick Pattern - Candles

Hammer Gold Candlesticks

Hammer gold candle-stick setup is a potentially bullish gold candle-stick setup which forms during a downward trend. It's named and called so because the market is hammering out a bottom.

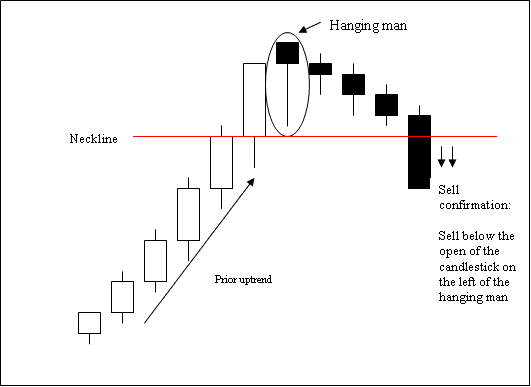

Hanging Man XAUUSD Candlesticks

This hanging man candlestick pattern formation is a potentially bearish gold reversal signal which forms during a upward trend. It's named and called so because it looks like a man dangling on a noose up high.

Hanging Man Candle Pattern

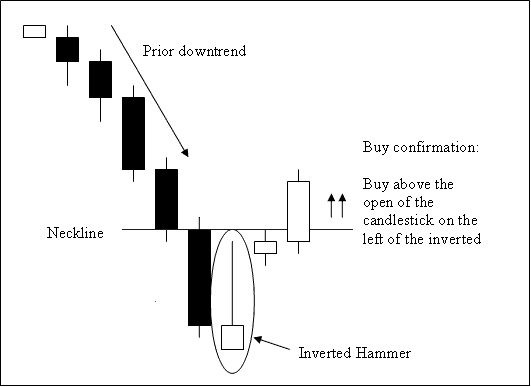

Inverted Hammer Candlesticks

This is a bullish price reversal candlestick pattern. It forms at the bottom of a trend.

Inverted hammer candle pattern forms at the bottom of a down gold trend & reflects possibility of a market price reversal of the downwards trend.

Inverted Hammer Candle Pattern - Candlesticks - How to Identify a Candle Pattern

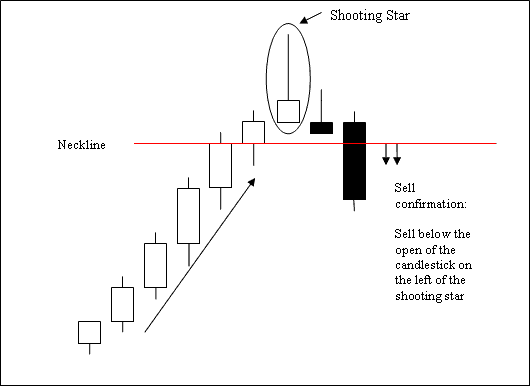

Shooting Star XAUUSD Candlesticks

Shooting Star Candle is a bearish price reversal candle pattern. It occurs at the top of a trend.

Shooting Star gold candle-stick pattern form at the top of an up trend in the market where the opening price is same as the low & price then rallied upwards but was pushed & forced back downwards to close near the open.

Shooting Star Candle - Candles

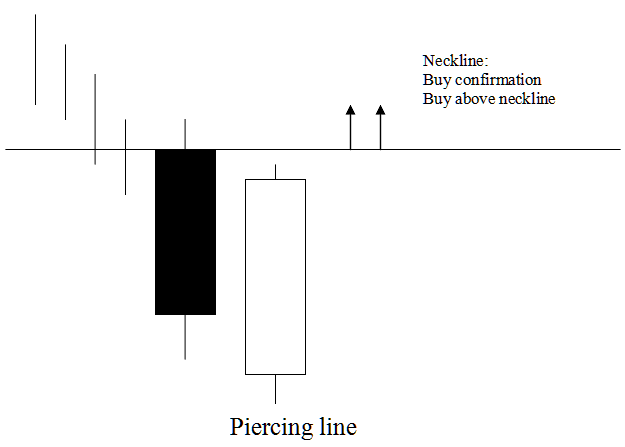

Piercing Line Gold Candlesticks

Piercing line candle setup pattern is a long black body followed by long white body stick.

The white body pierces the mid-point of the prior black body.

This Piercing Line gold candle pattern is a bullish price reversal candle pattern that forms at the bottom of a market downward trend. It shows that the market opens lower & closes above the mid-point of the black body.

This Piercing Line gold candle-stick pattern illustrates that the force of the downwards xauusd trend is reducing/decreasing and the price trend is likely to reverse & move in an upwards direction.

This Piercing Line gold candle pattern is shown referred to as a piercing line signaling that the market is piercing the bottom illustrating a market floor for price downwards trend.

Piercing Line Candle Pattern - Candles

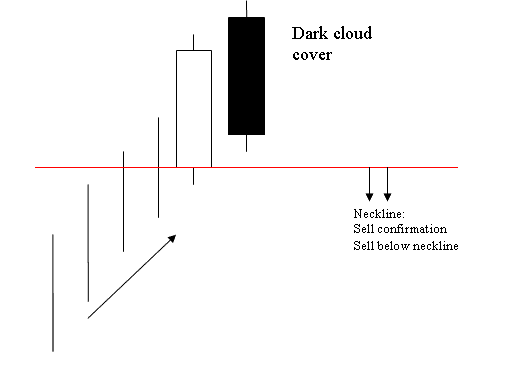

Dark Cloud Cover Gold Candlesticks

Opposite of piercing candle candlestick.

This candle is a long white body followed by a long black body.

Black body pierces the mid-point of the prior white body.

This is a bearish price reversal xauusd setup which forms at the top of an upwards trend.

Dark Cloud Cover gold candle-stick set-up that the market opens higher & closes below the mid-point of the white body.

Dark Cloud Cover gold candle pattern illustrates that the force of the up trend is reducing/decreasing and the price trend is likely to reverse and move in a downward gold trade direction.

Dark Cloud Cover gold candle pattern is cited referred to & known as a cloud cover signaling the cloud as a ceiling for price upwards trend.

Dark Cloud Candlestick Pattern

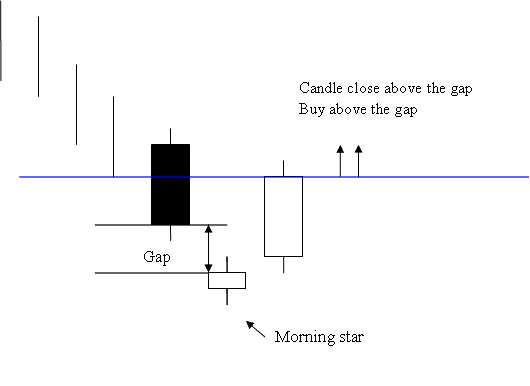

Morning Star Gold Candlesticks

Morning Star Candle Pattern - Candles

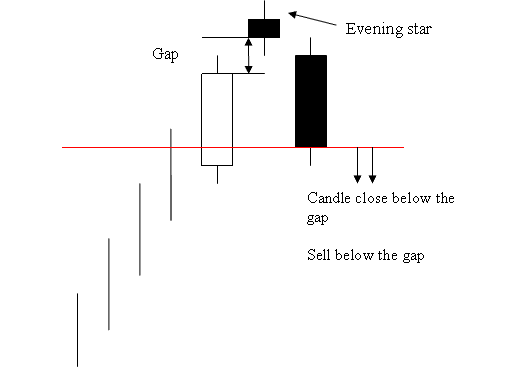

Evening Star Gold Candlesticks

Opposite of the morning star candles setup

Evening Star Candlestick Pattern - Candles

Candlesticks

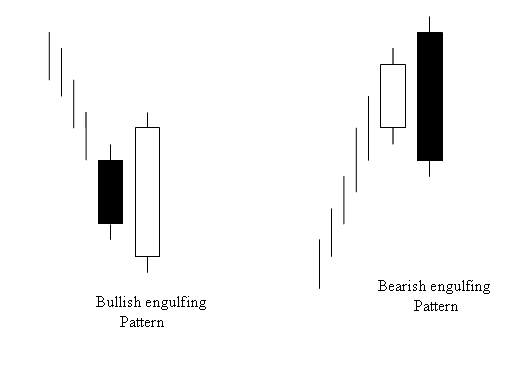

Engulfing is a reversal candle pattern which can be bearish or bullish depending upon whether it displays up at the end of a market down xauusd trend or at the end of a market upwards trend.

Bullish & Bearish Engulfing Candles Setups - Candles

Drawing Candlesticks on the MetaTrader 4 Software - Candlesticks Patterns Guide for Day Trading

Candlesticks patterns that every gold trader should know.

More Tutorials & Lessons:

- MT4 Margin Level : Explanation of How to Calculate XAUUSD Leverage in MT4 Platform Software

- One of the Best XAUUSD Account Bonus Including Lot Rebates & Gold Cash Back

- Learn XAU/USD Tips for Successful Trade

- What are XAU USD Chart Trade Patterns?

- Pending Gold Orders: Sell Limit XAU/USD Order

- Classic Divergence XAUUSD Setup

- Support & Resistance Levels in Gold Trading