Stochastic Oscillator Indicator Trading Analysis and Stochastic Oscillator Technical Signals

Developed & Created by George C. Lane

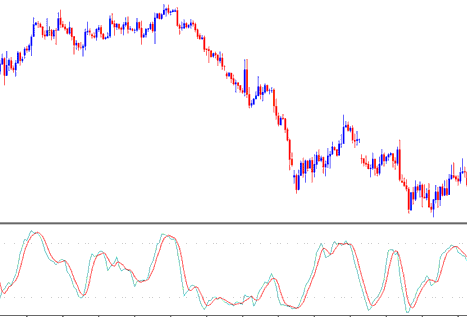

Stochastic is a momentum technical technical indicator - it shows the relation between the ruling closing price in relation to the high & low range over a given No. of n periods. Oscillator Indicator uses a scale of 0-100 to draw its values.

This Oscillator is based on the theory that in an up trend market the price closes near high of price range and in a downwards trending market the price will close near the low of the price range.

The Stochastic Lines are drawn as 2 lines- %K & %D.

- Fast line %K is the main

- Slow line %D is the trading signal

Three Types of Stochastics Trading Oscillators Indicators: Fast, Slow and Full Stochastics

There are 3 types are: fast, slow and full Stochastic. The three technical technical indicators look at a specified chart period for example 14 day period, and measures how price of today's close compares & analyzes to the high and low range of time period that's being used to calculate the stochastic indicator.

This oscillator works on the principle that:

- In an upwards trend, price oftenly tends to close at the high of candlestick.

- In a downwards trend, price tends to close at the low of candlestick.

This indicator shows the force of the trends, and identifies the times when a market is over-bought or oversold.

Analysis and How to Generate Trading Signals

Most common techniques used for analysis of Stochastic Oscillators to generate signals are cross-overs signals, divergence signals and overbought over-sold levels. Following are the methods used for generating trade signals

XAUUSD Cross-over Signals

Buy signal - %K line crosses above the %D line (both lines heading and moving upwards)

Sell trading signal - %K line crosses below the %D line (both lines heading downward)

50-level Cross over:

Buy signal - when stochastics indicator lines cross above the 50 center line a buy signal gets generated.

Sell signal - when stochastic indicator lines move below 50 a sell signal gets generated.

Divergence XAU/USD Trading

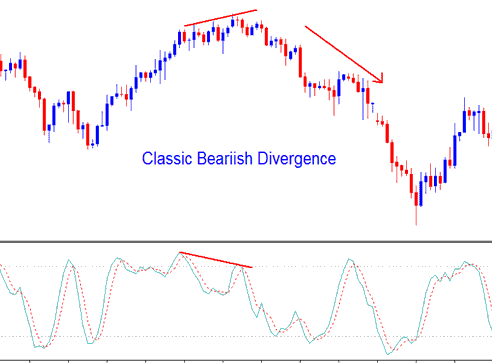

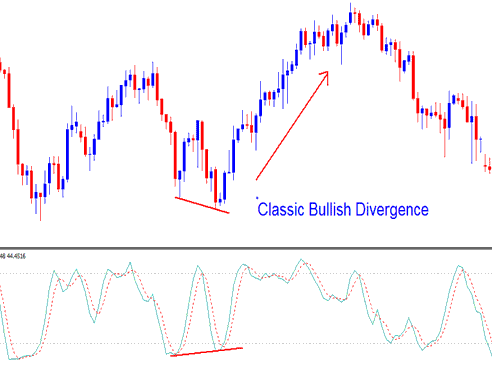

Stochastic is likewise used to look for divergences among this technical indicator and the charge.

This is used to determine potential trend reversal setups.

Upward/rising trend reversal - identified by a classic bearish divergence

Gold Trend reversal - identified by a classic bearish divergence

Downward/descending trend reversal - identified by classic bullish divergence

Gold Trend reversal - identified by a classic bullish divergence setup

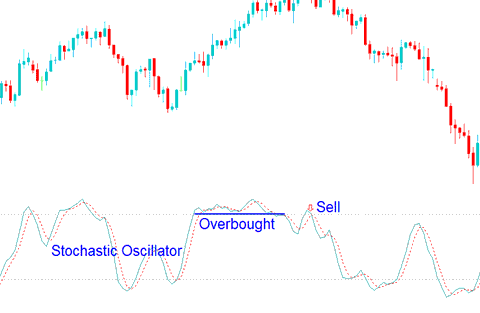

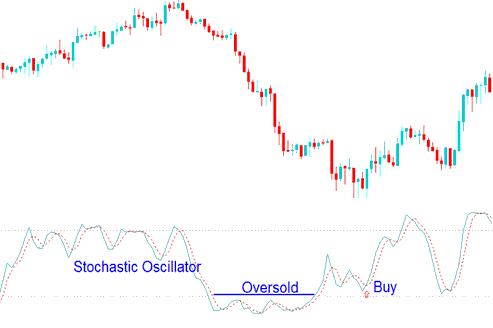

Overbought/Over-sold Levels in Indicator

Stochastic is mainly used to identify the potential over-bought and over-sold conditions in price moves.

- Over-bought values greater than 70 level - A sell signal forms when the oscillator rises above 70% & then falls below this level.

Overbought - Values Greater 70

- Over-sold values less than 30 level - a buy signal gets generated when oscillator goes below 30% and then rises above this level.

Over-sold - Values Less Than 30

Trades are derived/generated when Stochastic crosses these technical levels. However, overbought/oversold levels are prone to whip-saws especially when market is trending upward or downward.

Study More Topics & Courses:

- How to Trade XAUUSD Charts Using MetaTrader 4 Platform

- How to Trade Knowing the Difference Between a Sell Limit Order and a Buy Limit Order

- Choosing Your Gold Broker – What Really Matters

- How Do You Trade Triple Exponential Average Technical Indicator?

- MT4 Gold Technical Indicators Insert Menu on MT4 Insert Menu Options

- Using MQL5 Signals on MetaTrader 4 and MetaTrader 5

- Stochastic Oscillator as a Gold Indicator

- Complete Learn Tutorial Training Course Tutorial

- Gold Indicator: Ultimate Oscillator

- XAUUSD Inverted Hammer – What This Gold Candle Tells You