Inverted Hammer Bearish Candle-sticks Pattern

Inverted Hammer Bullish Candle-sticks Patterns

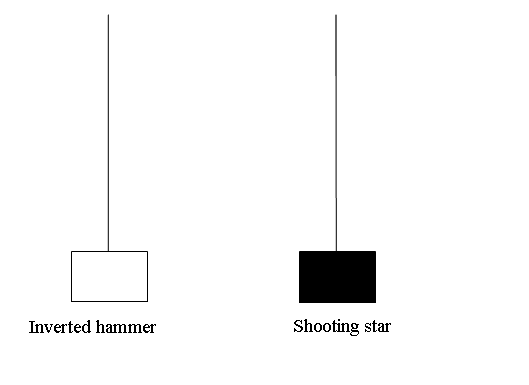

Inverted Hammer Candlesticks Pattern and Shooting Star Candles Pattern candlesticks look similar. These candles have a long upper shadow and a short body at the bottom. Their fill colour doesn't matter. What matters is the point where these candles appear whether at the top of a market trend (star) or the bottom of a market trend (hammer).

Inverted hammer forms a bullish reversal pattern. Shooting star signals a bearish reversal.

Upwards Trend Reversal - Shooting Star Candlesticks Pattern

Downward Trend Reversal - Inverted Hammer Candlesticks pattern

Setups Involving Inverted Hammer and Shooting Star Candlestick Patterns

Inverted Hammer Candlesticks Pattern

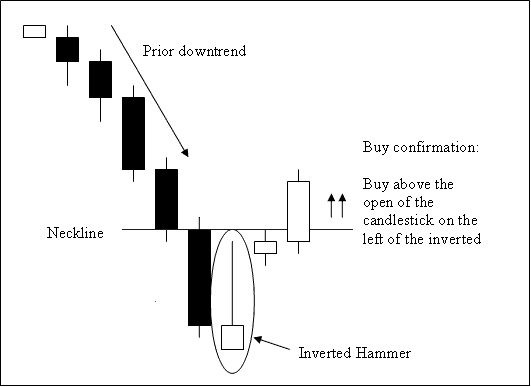

An Inverted Hammer Candles Pattern is a sign that prices may go up, and it happens at the bottom of a XAUUSD trend.

The inverted hammer candle pattern appears at the conclusion of a downtrend and suggests a potential reversal of that downward trend.

Trading Analysis of the Inverted Hammer Candle-sticks Pattern - How to Trade Inverted Hammer Candlestick Patterns Setups - Inverted Hammer Candle-stick Pattern,

Analysis of the Inverted Hammer Candlesticks Pattern

A buy is confirmed when a candlestick closes above the line of the upside-down hammer candles pattern, which is the opening price of the candles on the left side of this pattern. The line at this point is the resistance level.

The stop loss orders for the buy xauusd trades should be placed a few pips below the lowest price on the recent low of this inverted hammer candles pattern setup formation.

The inverted hammer candlestick formation receives its name because it visually suggests that market participants are actively attempting to establish a market bottom.

Learn More Lessons & Lessons:

- How do you trade with the Bollinger Band indicator?

- How to Get MetaTrader 4 Installed

- Gold Hint of a XAU USD Staying in One Place

- The Top Educational Platform and Training Course Resources

- Getting going with XAUUSD using MetaTrader 4 Brokers and Learning XAUUSD Program

- How should you approach countertrend gold trading?

- Instructions for Drawing an Upward XAUUSD Channel on the MT5 Application?

- How to Trade Regular Bullish Divergence and Bearish Divergence on Gold Charts

- Where do you find the chart objects list on MetaTrader 4?

- How to Add Market Facilitation Index Trade Technical Indicator on XAUUSD Chart