MACD Analysis Buy & Sell Trading Signals

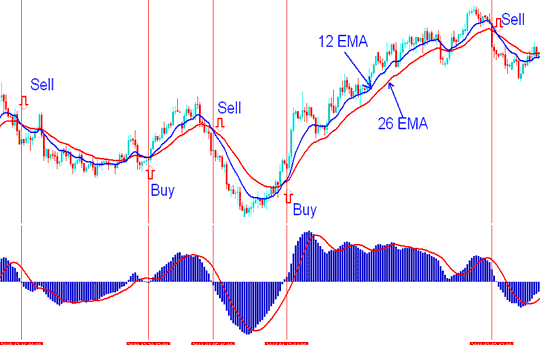

Since the MACD indicator is based on the 26 and 12 Exponential Moving Averages, we will compare these two EMAs with the MACD to understand how buy and sell signals are formed.

MACD - Example of MACD Indicator

Japanese candlestick charting also features numerous patterns utilized by technical analysts for market trading. Each of these patterns carries a distinct interpretation for technical analysis purposes.

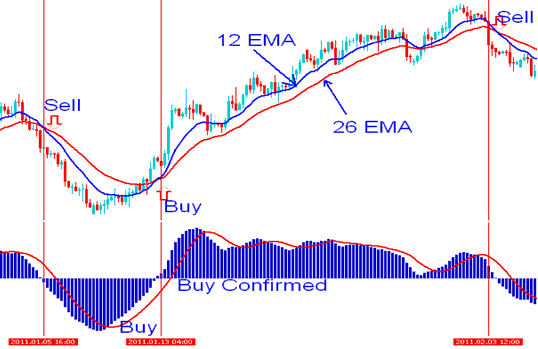

Buy XAUUSD Trade

A buy signal occurs when the MACD fast line crosses above the signal line. However, like most leading indicators, these signals are susceptible to whipsaws or false triggers.

To eliminate the fake-outs it's good to wait for confirmation of the buy/sell trading signals. The confirmation trading signal is when the two lines cross above the zero mark, when this happens the buy derived & generated is a reliable signal.

In the illustration shown & described below, the MAs gold indicator generated/derived a buy signal, before price started going upward. But it wasn't until the MACD moved above the zero line that the buy signal was completed, and the Moving Averages also gave a crossover gold signal. From experience it is always good to buy after both MACD lines move above zero center line mark.

Where to Buy using MACD - Buy Trading Signal

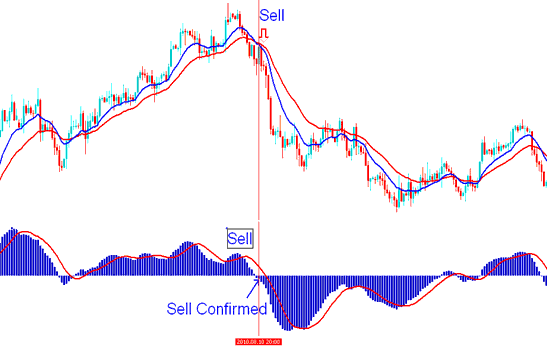

Sell Trade

A sell signal gets generated when there is a MACD fastline crosses below signalline. However, just like the buy signal, these also are prone to whipsaws/ fakeouts.

To avoid false sell signals or whipsaws, it's advised to wait for confirmation. A reliable sell signal is confirmed when two indicator lines cross below the zero line.

In the illustrations shown & described below, the MAs generated a sell signal confirmed after MACD moved below the zero line the same time that the Moving Averages gave a cross-over signal.

Where to Sell using MACD - Sell Signal

More Guides & Lessons:

- A Gold Trading Strategy Focused on Generating XAUUSD Buy and Sell Signals

- Opening a Removed Gold Chart in MetaTrader 4 Program

- What Happens When Your Free Margin for XAU/USD Runs Out?

- A List of Simple Gold Strategies for New Gold Beginner Traders

- What's NDD XAUUSD Account Meaning?

- Online Trading for Gold

- Trade MT5 XAUUSD Trend Lines and Gold Channels Indicator on MetaTrader 5

- MM XAUUSD Account – How It's Shown and Explained

- Gold Place XAUUSD Symbol in MT4 Android App Platform