Analysis of Gold Momentum Trading and Buy/Sell Signals from the Momentum Oscillator

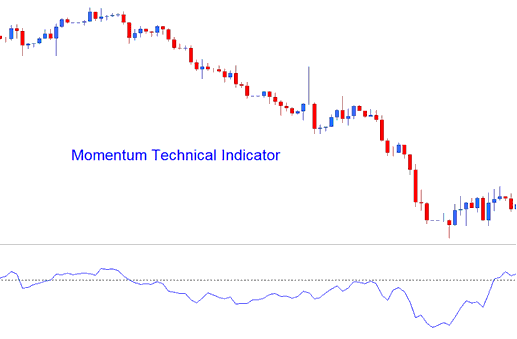

The momentum indicator uses math equations to calculate the line of plotting. Momentum measures velocity with which xauusd gold price changes. This is calculated as the difference between the ruling price candle and the mean average price of a chosen No. of price bars ago.

Momentum describes the speed at which the price alters over specified time intervals. A faster price increase indicates a greater surge in underlying force, just as a rapid price fall shows a more significant reduction in strength.

When price momentum slows down, market dynamics often shift back towards a median level of stability.

Momentum

XAU/USD Analysis and Generating Signals

This indicator is used to generate technical buy and sell signals. The three most common methods of generating signals used in gold trading are:

Zero Centerline Gold Trading Crossovers Signals:

- A buy signal gets derived and generated when Momentum crosses above zero level

- A sell trading signal gets derived & generated when Momentum crosses below zero mark

Over-bought/Oversold Levels:

Momentum serves as an indicator for identifying overbought/oversold conditions, pinpointing potential extreme levels based on prior readings and values: the determination of overbought and oversold thresholds relies on the momentum's preceding high or low point.

- Readings above the overbought level mean gold is overbought and a price correction is pending

- While readings below the over sold level the price is oversold and a price rally is pending.

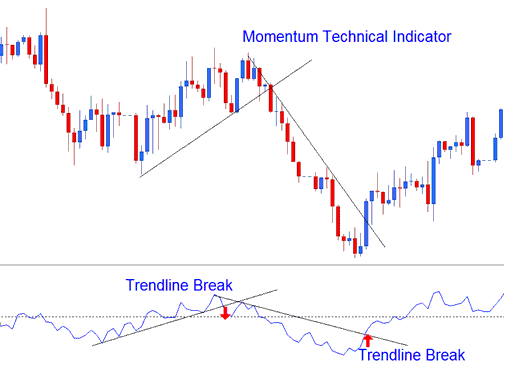

Trend-Line Break-outs:

Trend lines can be drawn on the Momentum technical indicator, connecting the high and low points. Momentum changes direction before price, making it a technical indicator that can predict the future.

- Bullish reversal - Momentum values breaking above a downwards trendline warns of a possible bullish reversal setup while

- Bearish reversal - momentum values breaking below an upwards trendline warns of a possible bearish market reversal gold signal.

Analysis in XAU/USD Trading

Study More Courses & Guides:

- How does a beginner start trading XAUUSD?

- Understanding stop loss placement using the Parabolic SAR for XAU/USD.

- How do you analyze Rainbow charts for XAU/USD technical indicators?

- How to Spot a Possible Trend Line Break and Reversal

- Weekly XAU USD Chart Trading System

- Bullish Marubozu Candlestick Patterns: A Guide to Successful Trading

- How Do You Use List of XAU/USD Price Movement Trading Plans?

- What's Margin Level in MetaTrader 5?

- Instructions for Trading the XAU/USD Symbol Within MT5 Software

- Understanding Hanging Man Bearish Candlesticks