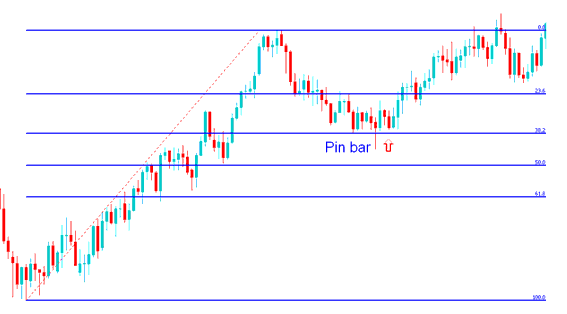

Pin bar price action method

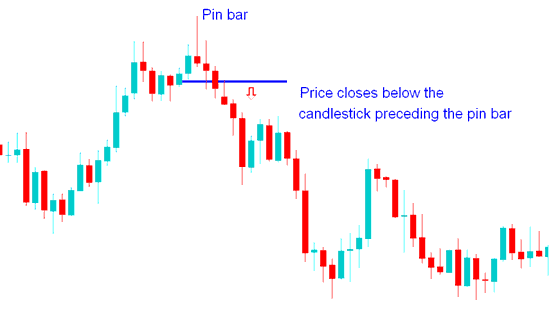

A pin bar on a chart signifies a reversal signal showing a clear sentiment change within that timeframe.

This bar has a long tail with closing xauusd price near the open.

Bar looks like a pin thus the title Pin-Bar - occurs and forms after an extended move upward or downward.

The reversal pattern becomes valid only after the market closes below the candle preceding this formation. Specifically, the reversal is confirmed when the market closes beneath the blue candlestick that came before it.

Combining with line studies:

This particular signal can be effectively integrated with other charting tools, such as Support and Resistance levels, Fibonacci retracement lines, and trend lines, to consolidate the generation of buy or sell trading decisions.

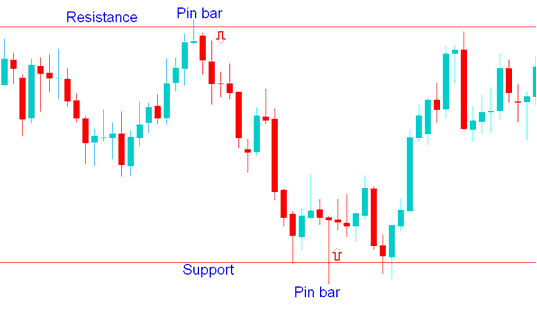

Support and resistance

A pin bar after testing support or resistance can signal a trade entry. Take trades against the tail's direction when this pattern appears.

If the market moves upwards this forms a pin bar with tall upper tail, then the signal is to short.

If the market exhibits downward movement and then generates a pin-bar with an elongated lower shadow, the suggested trading action is to enter a long position.

Combining Together with Support & Resistance

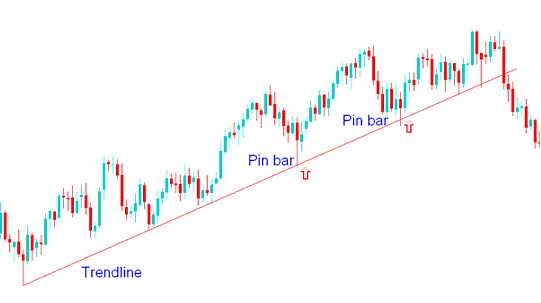

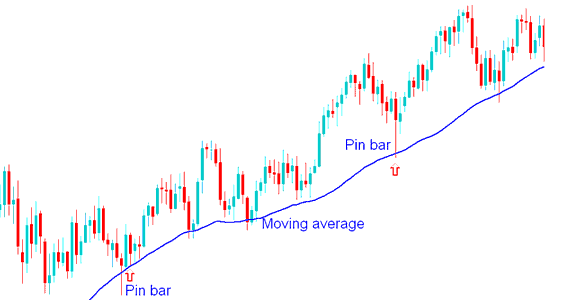

XAUUSD Trendlines & moving averages

Pin bars that materialize immediately following price interaction with (touching or testing) a trend line or a moving average (MA) can be interpreted as valid signals for market entry.

Combining with TrendLines

Combining Together with Moving Averages

Gold Fibonacci Retracement Levels

Pin bars that manifest immediately after the price interacts with a Fibonacci retracement level can also be effectively utilized as entry triggers for market participation.

Combining Together with Fib Retracement Zones

These patterns build at swing highs or lows. They follow fake breaks often. Traders use them to bet against the main trend, from the tail's direction.

Get More Lessons & Tutorials:

- Moving Average Crossover Method for Gold

- How to use the Ultimate Oscillator for forex buy signals

- Gold Market Opening Schedule

- Buy Stop Order versus Sell Stop Order

- Explanation and Examples of Market Execution for XAU USD Orders

- Placing a New XAU USD Order on the MetaTrader 5 iPhone Trading Application

- Calculator for margins on MT4

- Learning How to Operate the MT4 Mobile App on an iPhone

- How do you tell when a new XAU/USD trend is kicking off?

- Chart Tool Bar Menu & How to Change the Chart Tool Bars Menu in MT4