Three Common Patterns

Gold chart patterns is the study of repeating chart patterns that are commonly used to trade the markets. This chart patterns Tutorial helps traders learn how to read these patterns & how to interpret the signals given by these patterns.

Learn Pattern PDF

The Three common gold trading patterns are:

1. Reversal Setups

- Double Tops Setups

- Double Bottom Patterns

- Head and Shoulders Setups

- Reverse Head and Shoulders Setups

Reversal Setups Lessons

Double Tops and Double Bottoms Patterns in the

Head and shoulders Patterns & Reverse Head & shoulders Patterns

Reversal Setups confirm a change in the direction of the price trend once validated. These reversal patterns emerge following an extended market trend, whether an uptrend or downtrend, and signal an imminent shift or reversal in the prevailing price action.

2. Continuation Patterns

- Rising Triangle Patterns

- Falling Triangle Patterns

- Bull Flag/Pennant Patterns

- Bear Pennant/Flag Patterns

Lessons on Continuation Patterns and Tutorials

Recognition of Continuation Chart Patterns

Continuation Patterns are setups that get the market ready for a continued trend in the direction the market was already going. These patterns happen when the market takes a quick break before moving again in the same direction as its previous trend.

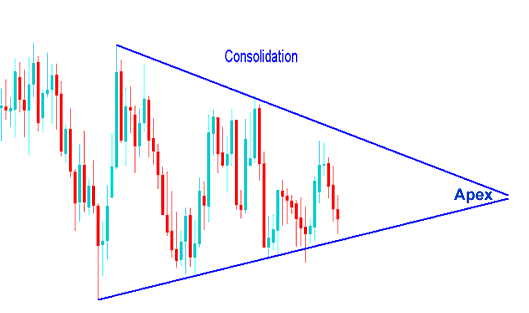

3. Bilateral Setups

- Symmetric Triangle - Consolidation Patterns

- Rectangle - Range Patterns

Consolidation Patterns Tutorials

Identifying and Trading Consolidation Chart Patterns

Consolidation patterns show market breaks before picking a path. The price weighs options on direction during these setups.

Chart Patterns Tutorials

Patterns - Study of a candles trading patterns

Patterns - What is Patterns?

Review Further Instructional Material & Directions:

- Installing MetaTrader 4 Trade Gold Software

- Fibo Pullback Levels on Gold Charts

- How Do I Activate a MetaTrader 4 Automated Expert Advisor(EA) in MT4 Trade Platform?

- How to Use Kurtosis Indicator on Chart

- Set TP and SL for XAU/USD: Use Take Profit and Stop Loss Orders on MT4 Platform

- How to Use MetaTrader 5 Android XAUUSD Course Tutorial for Beginners

- How to Draw Gold MT5 Trendlines in MetaTrader 5 Charts

- How to Trade Ascending Triangle Pattern in Gold