Money Management Styles & Methods in Gold Trading

The most effective method for practicing successful money management in XAUUSD trading is for the gold trader to ensure that their profits consistently exceed their incurred losses. This principle is known as the risk-to-reward ratio.

High Risk: Reward Ratio

This risk-reward ratio boosts profits in your strategy. Trade only when you stand to gain more than three times your risk on an XAUUSD position.

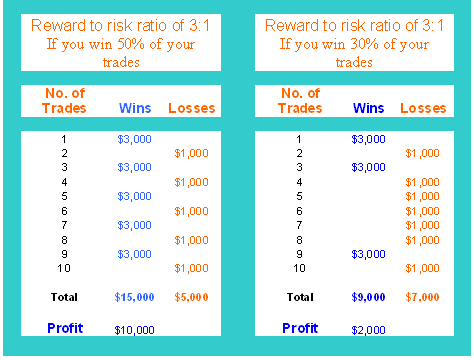

When you trade Gold with a risk-reward ratio of 3:1 or higher, your odds of long-term profit rise. The chart below explains this idea in the market.

As shown in the first example, even achieving a 50% success rate in Gold trades can yield a profit of $10,000. Even if the winning percentage drops to 30%, profitability can still be realized, as demonstrated in the second example.

Just keep in mind that if you have good risk-reward numbers, you're more likely to make money, even if you don't win as often.

Avoid risk ratios where potential losses exceed expected gains. For instance, risking $1,000 to earn $100 is not a wise approach.

Because you have to win 10 times more to make $1,000 back even if you lost only 1 trade.

If you incur one loss as a gold trader after several wins, you may have to return all profits from the other successful trades.

This type of investment strategy is illogical and will result in losses over the long term, without exception!

% Risk Method

The percentage risk method involves allocating a fixed percentage of your trading account equity per trade, promoting consistent risk management.

Percentage risk based method/technique specifies that there will be a certain percent of your equity balance that is at risk per position. To calculate the percent per every trade, you need to know 2 things, the percentage risk that you've chosen and lot size of an open order so as to calculate where to put the stop loss order. Since the % is known, we shall use it to calculate the lot size of the order to be placed in the Market: this is referred to as position size.

Example

If you as trader have an account balance of $50,000 in your trading account and risk percentage is 2 %

Then 2 % is the same as $1,000

If three investors buy XAUUSD, with one using a 100 pips stop-loss order, another selecting a 200 points stop, and the third using a 250 points stop, their position sizes will align accordingly.

Example 1:

Stop loss = 100 pips

Risk percentage = 2 percentage = $1,000 dollars

100 pips = $1,000

1 point =1,000/100= $10 dollars

Example 2:

Stop loss = 200 pips

2 percentage = $1,000

200 pips = $1,000 dollars

1 point =1,000/200= $5

Example 3:

Stoploss = 250 pips

2 percent = $1,000

250 pips = $1,000

1 point is calculated as 1,000 divided by 250 equals 4 dollars

Example: A gold trader with $50,000 wants to assess the annual income generated from his trading strategy.

Annual Income Calculation: If your trading system achieves a 70% win ratio with a risk-reward ratio of 3:1, a 100-pip stop loss, a 300-pip take profit, and you execute 100 trades monthly using standard lots, your maximum annual income would be approximately:

For one standard XAUUSD lot profit per 1 pip is $1

100 trade transactions*12 months = 1,200 trade transactions

Wins & Profit

70% win: 70 % of 1,200 = 840 profitable trades

840 transactions multiplied by 300 pips equals 252,000 pips.

252,000 pips = $252,000 dollars

Losses

30% Losses: 30% of 1200 Equals 360 Failed Trades

360 trade transactions * 100 pips = 36,000 pips

36,000 pips = $36,000

Net Profit = 252,000 - 36,000 = 216,000 pips

Earnings: 216,000 pips equals 216,000 dollars.

The above is just one example of the money you'll make, and it will depend on how your Gold system balances risk and reward, plus its win rate.

Other factors and aspects to consider include:

Maximum Number of Open Position A final point which to consider is the max number of open trade positions - that is the max number of trade positions that you want to be in at any one time. This is another aspect/factor to decide when managing your trading account capital.

For instance, if you adopt a 2% risk management protocol per trade, you might simultaneously limit yourself to holding a maximum of 5 positions. Should all four of those positions close out at a loss on the very same trading day, your equity balance for that day would reflect an 8% reduction.

Invest Sufficient Capital One of the worst mistakes that traders can make is attempting to open a trading account without enough capital.

Traders with small accounts often feel anxious. They set tight stops to limit losses, but end up exiting trades too soon, missing out on profits.

Master discipline to profit from gold trading. Discipline means you plan your trades and follow that plan for XAUUSD.

It is the ability to give a Gold trade the time to develop without hastily taking yourself out of the market simply because you're uncomfortable with risk. Discipline is also the ability to continue to stick to your plan rules even after you've suffered losses. Do your best to cultivate the level of discipline required and needed to be profitable when trading Gold online.

Managing Trade Account Capital Basics

Effective money management constitutes the bedrock of any Gold trading approach, assisting investors in realizing gains while transacting in the online spot Gold market. This practice is absolutely essential when dealing in the XAUUSD market, which involves leverage.

Successful investment in online gold trading demands a solid money management strategy due to the leverage used in placing orders. Understanding this aspect is crucial for effective trading.

Always measure the gap between average wins and losses. Wins must top losses on average. Otherwise, XAUUSD trading brings no gains. Each trader sets personal rules. Success ties to unique skills. Investors build their own strategies and money rules based on these tips.

When you place XAUUSD trades, set stop-loss orders to avoid big losses. You can also use stop orders to lock in profits.

Think of your chances of gaining profit compared to loss as 3:1 - this should be better for making profit. By thinking about these rules, you can make your plan more profitable and try making your own plan which might give you good profits.

Discover More Subject Areas & Training:

- Guide to Learning XAUUSD Patterns

- Hands-on Fibonacci Drawing Exercises for XAU/USD Charts

- How to Draw XAUUSD Trend-line in XAUUSD Chart

- XAUUSD Support and Resistance Levels Technical Analysis

- Determining the Optimal XAU USD Leverage for a Twenty Dollar XAUUSD Position

- Accessing and Logging into a MetaTrader 4 Practice Demo Account

- How to Open a MT4 Real XAU/USD Account from MetaTrader 4 Platform