Definition Going Short in Gold Trading

An entry stop order is designed either to initiate a buy position at a price level situated above the current market price or to open a sell position below the currently ruling price.

Going short is therefore just another term used to refer to selling of gold.

You'll use charts to figure out when to sell: you'll sell if the prices on the charts are going in a downwards direction.

Definition Going Short in XAUUSD Trading

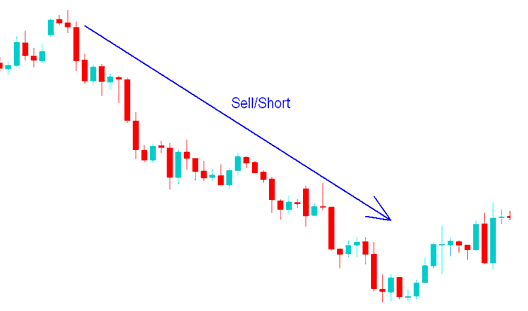

If the price is going down we sell gold, this is known & referred to as going short. When market trend is moving down it is known as to as a bearish market. The example shown & explained below portrays a downwards trend, this is when a short sell trade is placed & a gold trader goes short. The short sell is identified by drawing a downwards trendline on a xauusd chart. The example shown & explained below portrays a short sell signal.

What Does Engaging in a 'Short' Position on a Trading Asset Entail? - Defining Short Selling in Gold Transactions

Learn More Guides & Tutorials:

- Steps to Overlay the Market Facilitation Index Trading Indicator onto a Gold Chart

- A Beginner's Guide to Setting Up a Practice Account for XAU/USD on MT4

- Instructional Guide on How to Use Gold Trading Software

- Add Moving Average to XAUUSD Charts on MetaTrader 5

- What's the best way to trade listings of XAU/USD price action strategies?

- Loading Gold Templates for XAU/USD on MetaTrader 4 Software

- How to Analyze Gold (XAUUSD) Charts

- A Top XAU USD Broker for Scalping for Expert Advisor (EA) XAUUSD Bots and EA Traders

- Methodologies for Determining Optimal Stop Loss Placements for Gold (XAUUSD) Trades

- How to Build a MetaTrader 4 Automated Bot for Gold