What Happens in Gold After a Reversal Doji Candle Pattern?

This reversal doji candle pattern appears at market turning points and warns of a possible price trend direction reversal in the Trading market trend. Below is an example of this reversal doji candle pattern setup formation

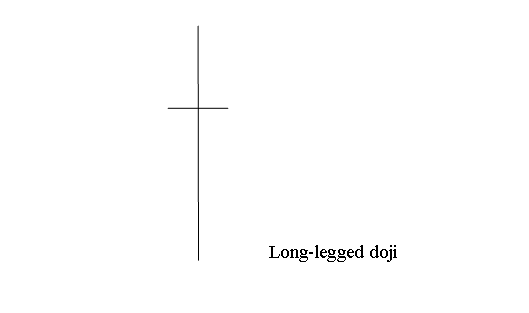

A doji candle has matching open and close prices. Charts show various types of doji patterns.

A doji candle happens when the price at the end of a certain time is very close to the price at the start. Doji candlesticks can look like a cross, an upside-down cross, or a + sign.

The reversal doji candle pattern typically appears at points where the market is likely to change direction. It serves as a warning of possible price trend reversals. An example of this pattern is shown below.

What Happens in Gold After a Reversal Doji Candle Pattern?

Understanding Doji Candlestick Patterns: Doji candlestick patterns show uncertainty in the trading market because buyers were in control at the high point, sellers were in control at the low point, but neither could maintain control, so the closing price matched the opening price.

The Doji candlestick pattern reveals minimal price movement for a specific day, which could range between 0 and 3 pips. Analyzing these candlestick formations involves paying attention to slight differences between the opening and closing prices.

Learn More Tutorials & Courses:

- Locating and Trading Gold (XAU/USD) Divergences Within Chart Analysis

- What is the Method for Putting a MT5 Moving Average(MA) Envelope Indicator on a Gold Price Chart?

- Comprehensive Guide to MT4 Software Functionality

- Gold Chart Trading – Using Divergence for Better Setups

- Getting started with XAU/USD: open a micro trading account for gold

- Procedure for Adding the XAUUSD Symbol to the MT4 Application on an Android Device.

- Utilizing the Fibonacci Expansion Levels Indicator for Trading Analysis on the MetaTrader 4 Software?

- Buy Stop Order versus Sell Stop Order

- Ten Gold Money Management Trading Strategies

- Setting a Pending XAUUSD Order Using the MetaTrader 5 Android Application