Managing Equity in Gold Trading: Understanding Drawdowns and Maximum Drawdowns

In business, understanding risk management is crucial to profitability. For Gold trading, it's essential to learn about various money management strategies, as detailed on the Gold trading educational platform.

In XAU/USD trading, manage risks from losses. Equity rules protect your account. They help you earn profits over time.

Draw-down

If you trade gold, the biggest risk you face is drawdown - that's how much money you lose in your account from a single trade.

If you have $50,000 in capital and suffer a loss of $500 in a single transaction, your drawdown is $500 divided by $50,000, or 1% of your capital.

Maximum Draw-down

This figure represents the cumulative amount your account balance has receded before you achieve positive profitability. For illustrative purposes, imagine starting with $50,000 capital, enduring 5 consecutive unsuccessful positions totaling a $2,500 loss, and subsequently realizing a $5,000 profit across 10 winning trades. The drawdown calculation then involves dividing that $2,500 loss figure by the initial $50,000 capital, resulting in a maximum drawdown percentage of 5%.

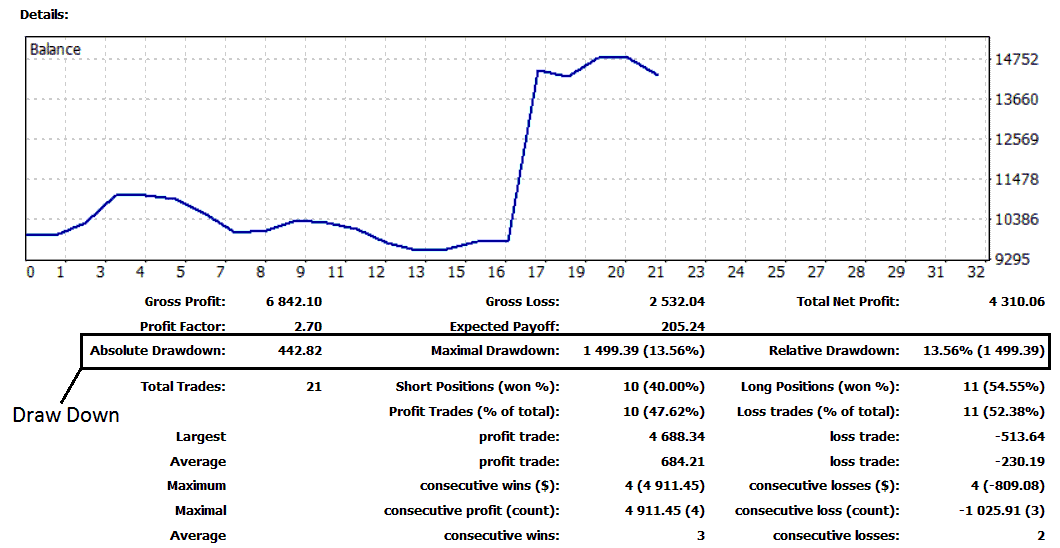

Draw Down on the example revealed above is $442.82 (4.4%)

Maximum Draw Down is $1,499.39 (13.56%)

To learn how to generate the above trading reports using MT4 software: You can search on how to generate trading reports on MT4 Tutorials and Lessons.

Funds Management Techniques

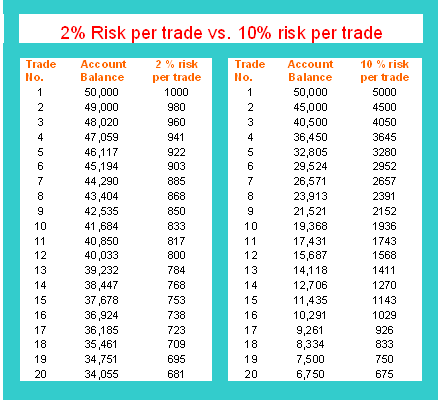

The example here shows the difference between risking a small part of your trading money compared to risking a bigger part of your trading money. Good trading rules say that you as an investor or trader should not risk more than 2% of your money on any single trade.

Percent Risk Method

2% and 10% Risk Rule - Equity Management Rules

In trading, risking 2% of your account money on one trade is very different from risking 10% of your account money on one trade.

If you risked 10% on each position and experienced a losing run while trading gold, losing just 20 trades in a row, you would have gone from a beginning balance of $50,000 to only $6,750 left in your account. More than 87. 5% of your trading equity would have been lost.

If you only risked 2% per trade, you'd still have $34,055 left - even after a 32% loss on your total trading equity.

This is why it is best to use the 2 % risk management strategy

There's a big difference between risking 2% and 10% per trade. If you stick to 2% risk and lose 20 trades in a row, you'll still have $34,055 left. But if you risk 10% each time, just five losses knocks you down to $32,805 - which is less than if you'd lost 20 trades at 2%. Smaller risks help you last longer.

The key is to establish your equity money management rules in such a way that, even during a losing period, you will still possess enough trading capital for the next opportunity.

If you lost most of your money, like 87.5% of it, you'd need to gain 640% on what's left to get back to even.

If you were to lose 32% of your trading funds, you would need to earn 47% profit on what's left to get back to where you started. In comparison to the example above, it is much easier to recover from a 47% maximum loss than from a 640% maximum loss.

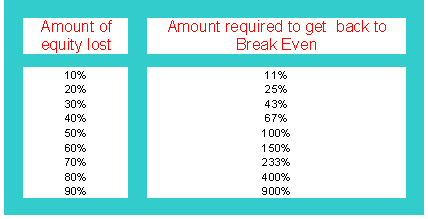

The subsequent chart demonstrates the percentage of your total trading equity you would need to recover just to break even following a specified percentage loss of your trading capital.

Concept of BreakEven

Account Equity and Concept of Break Even

Facing a 50% drawdown, a gold trader must achieve a 100% gain on the residual trading capital - a feat accomplished by fewer than 5% of global traders - just to recover to their initial break-even point after a 50% account depletion.

At 80 % draw down, a gold trader must quadruple their account equity just to bring it back to its original equity level. This is what is referred to as "break-even" i.e. Get back to your original account balance that you deposited after making a draw down.

The more you lose, the harder it's to make it back to your original trading equity.

This is the reason why as a trader you should do everything you can to PROTECT your trading account equity. Don't accept to lose more than 2% of your equity on any 1 single trade.

Effective money management entails risking only a small percentage of your trading capital on each trade, allowing you to endure periods of losses and prevent significant account drawdowns.

Traders set stop losses to limit how much they can lose: this means setting a stop loss order after placing a trade.

Effective Equity Management

Effective risk management strategy requires controlling all the trading risks. One should come up with a clear equity money management system and a plan. To be in XAU/USD trading business or in any other type of business you must make some decisions which involve some type of risk. All factors should be measured to keep risk to a minimum when trading Gold online and make sure you use the above tips on this guide.

Learn More Lessons & Courses:

- Instructions for Placing and Setting a Sell Stop Order Using MetaTrader 4 Trade Software

- Utilizing Pivot Points in Gold Chart Trading

- An Example of How to Write Guidelines for a XAUUSD Strategy

- Steps Required to Log In to an MT4 XAU USD Account

- XAUUSD Expert Advisor(EA) Bots Guide Tutorial

- Doji and Marubozu Candlestick Patterns Simplified

- XAUUSD Trade on MT4 iPhone Gold App

- Overview of Platforms and Broker Accounts Available for XAUUSD Trading

- Using a Gold Sell Limit Order in MetaTrader 4