Account Explanation

2 Types of Accounts

In recent years, retail trading has significantly increased in popularity, leading to a higher demand for various types of trading accounts. Numerous account options are available for any trader looking to invest in the online market, including Gold Accounts.

The Gold market lets you use a lot of leverage to bet on how the price will change. Traders can buy a lot of trading units using leverage: Gold Leverage is what makes trading xauusd appealing to many online traders: with leverage, a trader can make more money or lose more money because they use less of their own money and borrow the rest.

Various account types exist to assist investors in managing their capital effectively while optimizing their trading decisions.

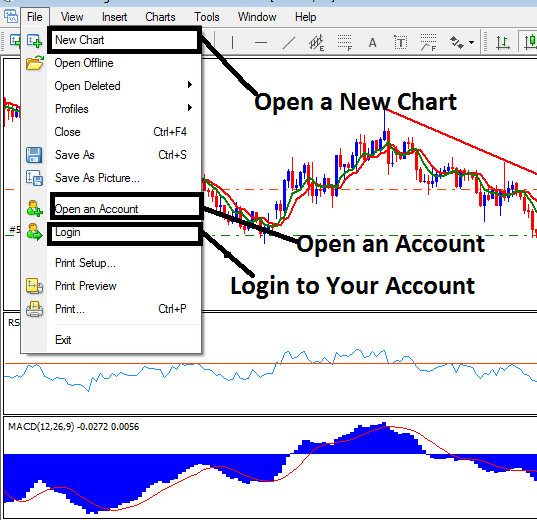

How a Live Account Looks Like

So, gold traders need to think about what they want to get from their trade before they choose which type of trading account to open.

Below is a comparative overview of the duo of account types typically utilized for gold trading. This review details the distinct characteristics associated with each account structure.

1. Standard Accounts Explained

The Gold Account, a typical account, is described in detail. The US dollar is the currency of the Standard Trading Account, and gold trades are executed using standard lots and contracts. Additionally, one lot is referred to as one contract. At the very least, the minimum opening equity should be $10,000.

lot refers to the minimum role size of a single transaction. This gold account option is the maximum suitable for investors with enough capital to spend money on xauusd - this gold account choice requires $10,000 & $50,000 greenbacks as starting capital, for this preferred account the dealer will no longer be undercapitalized & with accurate xauusd cash management guidelines and gold money control manual-strains, this general account choice has the nice chance for profitability because it is not undercapitalized. underneath-capitalization is what makes maximum traders in gold trading now not profitable.

It's not a good idea to start a standard account if you don't have a trading account with at least $10,000 dollars and up to $50,000 dollars.

Professional Money Managers recommend a minimum of $50,000 to open this basic account, as well as limiting trading transactions to only 2% of the capital in your trading account. But if you, as a trader, have more than $10,000, the majority of brokers will still register you for this standard account.

With gold leverage of 100:1, you'll borrow from your broker (with leverage option of 100:1, your broker provides you $100 for every $1 dollar that you have in your account, henceforth if you as a trader have $1,000 dollars, the broker will give you $100 dollars of leverage for each $1 dollar you have, meaning after leverage you'll have $1,000*100=$100,000 which you can then use to trade gold).

Micro XAUUSD Accounts Types Described

Gold Account Explanation - Micro Account. Micro Accounts use lot sizes of only equivalent one hundredth that of a standard lot. These Micro accounts are often appropriate for traders without a lot of gold capital & sometimes can be opened with only a $5 minimum balance.

A micro account lets you trade micro lots. One gold micro lot is one-tenth the size of a mini lot, and one-hundredth of a standard lot.

A Micro account is well-suited for traders with account balances between $1,000 and $5,000.

In gold trades, one standard lot sets the base size for deals in the market. Many brokers now sell smaller shares of that lot to help everyday traders join in. These tiny lots cut the smallest trade amount, so new folks or those with low funds can test the waters without big risks.

There are online lessons on trading that you can read and study before opening a real xauusd account. To get more trading practice, beginner traders should open a practice Gold demo account with an online broker to practice trading gold before opening a real xauusd account and using real money.

During demo practice with a training account, beginners should focus on building a solid foundation in gold trading by learning about gold-specific strategies, risk management, planning, and trading systems.

The types of strategies used and the skills required for any of these 2 accounts are essentially the same - those skills and strategies required for the Standard account or Micro account are the same the only difference to be adjusted are the gold funds management rules & guidelines for each account type.

Review Further Instruction Sets & Programs:

- Draw-down and Maximum Draw-down

- How Can I Interpret a New Gold Order on Gold MT4 iPhone Trade App?

- How to Download MetaTrader 5 XAUUSD Gold Platform for PC

- How Do I Read the Trade Market Tutorial Download?

- How to Set Relative Strength Index, RSI on Gold Chart

- XAU/USD Contracts Leverage Margin and Spread

- What is XAUUSD Price Action XAUUSD System?

- How Can I Learn How to Load MT5 Profile in MetaTrader 5 Software Platform?

- Detailed Explanation of How to Backtest an Expert Advisor (EA) Bot in MT5