Inverted Hammer & Shooting Star Candles

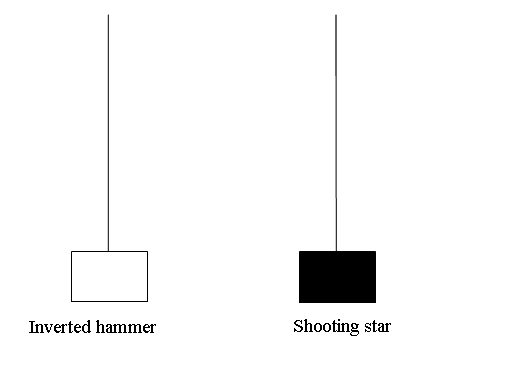

Inverted hammer candlesticks & shooting star candles look alike. These candlesticks have a long upper shadow & a short body at the bottom. Their colour doesn't matter. What matters is where they form, if at the top of a trend (star) or bottom of market trend (hammer).

The distinction between the two is that the shooting star candle is a bearish price reversal trade pattern, whereas the inverted hammer candle is a positive market reversal pattern.

Trend reversals are marked by specific candlestick patterns: Shooting Star for upward reversal and Inverted Hammer for downward reversal.

Inverted Hammer and Shooting Star Japanese Candles

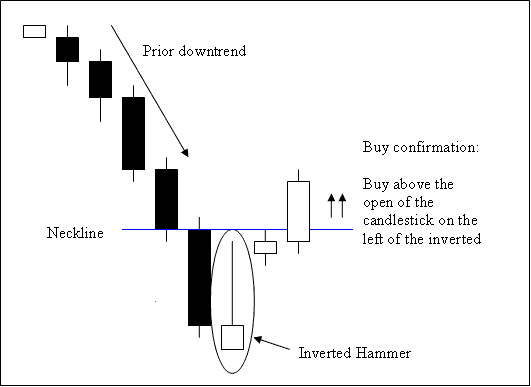

Inverted Hammer Japanese Candle

The Inverted Hammer candle is a sign that the market might go up after being down. It shows up at the lowest point of a Gold price going down. The inverted hammer candle shows up when prices are falling and shows that the Gold price might go back up.

Inverted Hammer Candlestick Pattern

Analysis of the Inverted Hammer Candle

A buy signal derived from the inverted hammer candlestick formation is validated when a subsequent candle forms and closes above the neck line, which is defined as the opening price of the hammer candle immediately to its left, as depicted above. In this scenario, the neck line acts as a resistance level.

If the next candle after the hammer does not close over the neckline, wait. Check if the following candle closes above it. The bullish reversal confirms only then.

Place stop orders for buy trades just below the latest low by a few pips.

An inverted hammer candle is called & named so because it signifies that the market is hammering out a bottom.

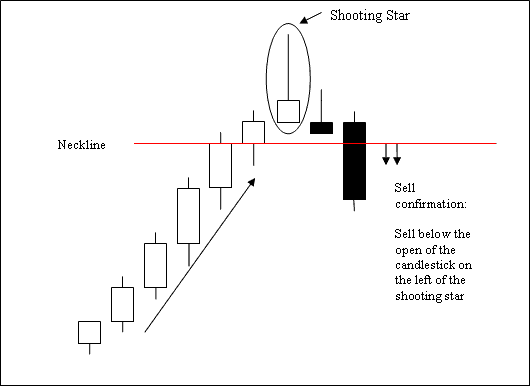

Shooting Star Japanese Candle

The Shooting Star candle is a bearish price reversal candlestick pattern. It forms at the top of an upward trending market.Shooting Star candle occurs at the top of an up trend where the open price of XAUUSD is the same as the low - meaning the price opened at that level rallied up but was forced back down to close near the same opening price level.

Shooting Star Candle Pattern

Trading Analysis of the Shooting Star Candle

A shooting star sell signal confirms when the next candle closes below the neckline. That's the open of the candle left of the shooting star, as shown. The neckline serves as support. Place stop orders a few pips above the recent high for these sells.

The shooting star candle forms at the peak of an up Gold trend. Its shape mimics a star in the sky, hence the name.

More Tutorials and Courses:

- Ichimoku Trading Strategy for Buy & Sell Gold Signals

- XAU USD Tutorial Topics Key Concepts in XAU/USD Online

- What Steps Should Be Taken to Load an MT4 XAUUSD Profile on MT4 Software?

- Looking at the XAU USD MA Indicator in XAU/USD Trading

- Looking to trade on MetaTrader 4 Android using XAU/USD? Here's how.

- How Can You Predict XAU USD Trend Reversal Gold Signal?

- How to Show the XAUUSD Symbol on the MT4 Phone App?

- Ten XAU/USD Money Management Strategies

- MQ5 Automated XAU USD Robots EAs EAs MQ5 CodeBase

- W Shape Divergence Pattern for XAUUSD