Bollinger Band Indicator Bulge & Squeeze Analysis

The Bollinger Bands are self adjusting which means the bands widen and narrow depending on gold trading price volatility.

Standard Deviation is the statistical measure of price volatility used to calculate the narrowing or widening of the trading Bollinger bands. Standard deviation will be higher when the prices are changing substantially and lower when the market trading prices are calmer.

- When price volatility is high the Bollinger Bands widen.

- When gold trading price volatility is low the Bollinger Bands narrows.

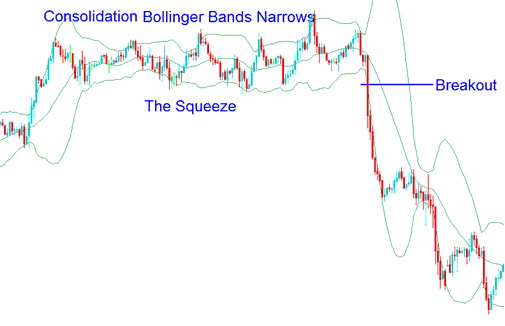

How Do I Trade Bollinger Bands Squeeze

A contraction of Bollinger Bands indicates price consolidation, commonly referred to as a Bollinger Band squeeze.

Narrow Bollinger Bands show low price swings and point to a pause. This often leads to a big move as traders shift spots. The more time prices hug those tight bands, the stronger the breakout odds.

Bollinger Squeeze - The Bollinger Bands Squeeze - How to Trade the Bollinger Band Squeeze

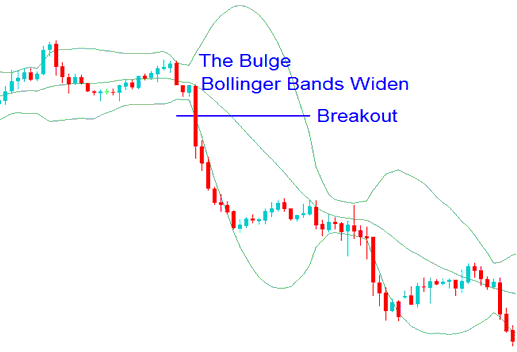

How Do I Trade Bollinger Bands Bulge

The widening of Bollinger Bands signifies a forthcoming price breakout, a phenomenon termed the Bollinger Band Bulge.

Wide Bollinger Bands signal a possible trend reversal. In the example below, the bands spread out during high volatility in gold prices on the downside. Prices hit an extreme low based on stats and normal distribution rules. The wide bands hint at a shift to an uptrend.

Bollinger Bulge - The Bollinger Bulge - How to Trade When the Bollinger Band Bulges

More How-To Guides and Subjects:

- Learning XAUUSD Money Management Trading Strategies Tutorial

- XAU/USD Divergence Meaning

- How Do I Draw Channels in MT4 Platform Software?

- One of the Best XAU/USD Broker for Scalping for Expert Advisor XAU/USD Bots & Expert Advisor Traders

- Can You Trade Gold Without XAUUSD Leverage?

- How Do I Use XAUUSD Sell Limit Order on MT5 Platform?

- Types of Technical Trend Indicators

- How to Identify a Candlestick

- How to Set MACD Technical Indicator on XAUUSD Chart in MT4 Platform Software

- Adding the XAU USD Symbol to the MetaTrader 4 Android Application Platform