Trading Double Tops and Double Bottoms Strategies

A trader should wait for the price to change direction after touching a gold Bollinger band to think that a gold reversal is actually taking place.

Even better a trader should see the price cross over the moving average MA.

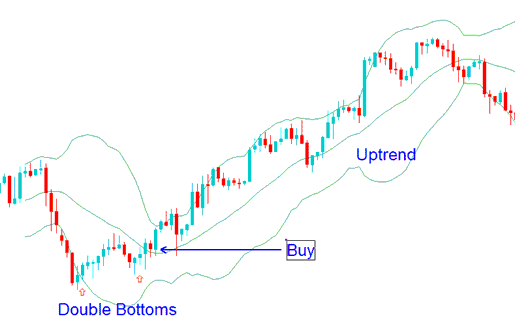

Double Bottom Trend Reversals

A double bottom signals a buy. It happens when price dips below the lower band, bounces to form the first low, then makes another low above it later.

The second low price should not be less than the first one, and it is important that the second low price does not hit or go past the lower band. This positive xauusd pattern is confirmed when the price goes past and stays above the middle band (simple moving average).

Double Bottom Pattern: Utilizing Double Bottom Setups in a Trend Reversal Strategy Guided by the Bollinger Band

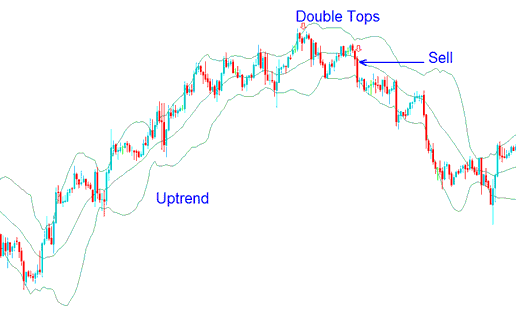

Double Tops Trend Reversals

Double tops are a signal to sell. A double top happens when the price goes past the upper band and then falls back down, creating the first high price. After some time, another high price forms, but this time it's below the upper band.

It is crucial that the second price high does not exceed the first one and that it does not come into contact with or break through the top band. When price behavior shifts and closes below the center band (simple moving average), this negative xauusd gold arrangement is confirmed.

Trend Reversals Based on Bollinger Bands Utilizing Double Top Formations in Strategy

Study More Courses and Topics:

- Trading Analysis with Japanese Candle Patterns

- Different Types of XAU USD Analysis

- How to Spot a Double Bottom in XAUUSD Trading

- Strategies for Trading in an Upward Trend

- Patterns of Consolidation in Gold

- What Occurs after a XAU USD Bull Pennant Shape?

- Gold Chart on MetaTrader 5

- How to Place a Chart in MetaTrader 4

- Looking when the XAU/USD forex market is open? I've got the trading hours.

- Find Symbols and Quotes in MT4