The Distinction Between the Maximum Leverage Set by a Broker and the Leverage Actually Employed by a Trader

If the set leverage option is 100:1, what this means is that you can borrow up to $100 for every one dollar that you have on your account, but you don't have to borrow all the $100 for every one dollar that you have, you can choose and select that you want to borrow 50:1 or 20:1. In this instance though leverage ratio is set at 100:1 your used leverage will be the 50:1 or 20:1 which you've borrowed to make a trade position.

Example:

You have $1000 (Equity)

Set 100:1

Leverage Used = Amount utilized / Equity

If you buy trading lots that are equal to $100,000 you'll have used

= 100,000/1000

= 100:1

If you buy lots that are equivalent to $50,000 you'll have used

= 50,000/1000

= 50:1

If you buy trading lots which are equivalent to $20,000 dollars you'll have used

= 20,000/1000

= 20:1

If you buy lots that are equal to $10,000 you'll have used

= 10,000/1000

= 10:1

In these 3 cases you can see that even though the set is 100:1

Brokers apply 100:1, 50:1, 20:1, or 10:1 ratios based on lot sizes traded.

Why not pick 10:1 as max leverage? Good risk rules suggest using even less.

This question might seem simple, but it really isn't, because when you trade, you're using borrowed funds called Leverage. If you borrow money from someone or a bank, you, as the trader, have to provide something of value as security for the loan, even if the security involves money taken from your paycheck each month, similar to trading Gold.

In gold trading the security is referred to as margin. This is the capital that you deposit with your online broker.

This is figured out as you trade. To keep the borrowed funds, you, as the trader, must have enough funds to meet the required capital, or your deposit.

Now if Your Leverage is 100:1

When trading, if you as a trader have $1,000 and use leverage ratio 100:1 and buy one standard contract/lot for $100,000 then your margin on this trade is the $1000 in your trading account, this is the money that you will lose out if your open trade position goes against you, the other amount $99,000 that's borrowed, they'll close out the open gold trades mechanically once your $1,000 has been taken out by the market.

This scenario applies provided your brokerage has set Margins to zero percent prior to automatically closing your gold trade positions due to a margin call.

If you need 20% before selling your xau/usd positions automatically, your trades will stop when your account balance goes down to $200.

If you have a 50% requirement at this level before automatically closing your gold holdings, then your trade positions will be closed when your account balance reaches $500.

If a 100 percent prerequisite is set before the system automatically closes your active transactions, your trade will be exited once your account balance hits the $1,000 mark. The rationale is as follows: The Gold trade position will be closed immediately upon opening, because even settling a 1-pip spread will cause your balance to fall to $990, which is short of the required 100% threshold (i.e., $1,000). Thus, your open orders will be stopped out instantly.

Most brokers do not set 100% requisite, but there are those which do set 100% aren't appropriate for you at all, select those set 50 % or 20 % margin requirements, in fact, those xauusd brokers that set their margin requirement at 20% are among some of the best since because of the likely hood they stop out-out your trade position is reduced and minimized just as is displayed and shown in the above example illustration.

To know about this level that is calculated by your platform automatically/mechanically - MT4 Software will show this as "Gold Margin Requirement", This will be shown as a % the higher the % the less ikely your positions are to get closed out.

For Example if

Using 100:1

When leverage is at 100:1 and you trade 1 Mini Lot, it also equals $10,000.

Capital required for trading: $10,000 (mini lot) divided by 100:1 leverage results in $100 utilized capital.

Calculation:

= Capital Used * Percent(100)

= $1,000/$100 * Percent

XAU/USD Margin Requirements = 1000%

Trader has 980 percent above the required amount

Using 10:1

When leverage is set at 10:1 and you execute a transaction of 1 Mini Lot, it corresponds to $10,000.

If Your Capital is $10,000 (representing a mini lot), and You Incur a 70% Loss, Your Remaining Equity Is $3,000, Requiring a $7,000 Gain to Return to $10,000.

Calculation:

= Capital Used * Percentage

Equals 1,000 divided by 1,000 times Percent(100)

Gold's Margin Requirement = 100%

Investor has 80% above the required amount

Higher leverage essentially translates to having a greater percentage buffer above the required funds (also known as more "Free Gold Margin"), thus reducing the likelihood of existing open gold positions being forcefully closed. This principle is why traders might opt for a 100:1 leverage setting on their account but, adhering to their risk management directives, will consciously avoid risking more than a 5:1 effective leverage ratio in their actual trades.

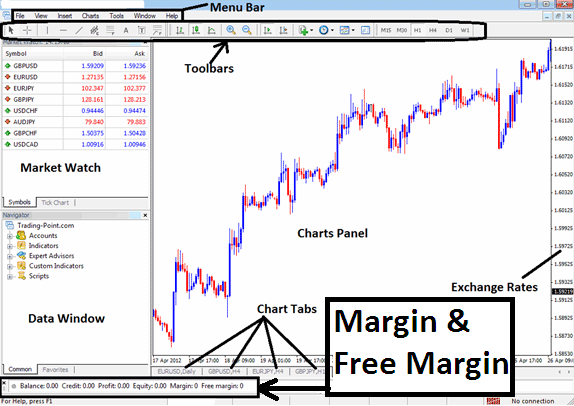

These Levels are Shown in the Trading Platform Screenshot Below as an Example:

MT4 Platform

Check Out Extra Lessons and Subjects:

- How to Analyze/Interpret Inertia Indicator Sell Forex Trading Signal

- XAUUSD Set and Place a StopLoss XAUUSD Order on MetaTrader 5 Android XAUUSD App

- MT5 Templates for XAUUSD Charts Menu Guide

- Daily XAUUSD Chart Strategy

- How to Put in a Sell Stop Order on Gold

- The Process of Drawing Downward Trend-lines for XAUUSD in the MT5 Software

- Bollinger Percent B or %b XAUUSD Indicator Analysis