How Do You Trade Rising Triangle Pattern?

How Do I Trade the Rising Triangle Pattern

Rising Wedge Pattern

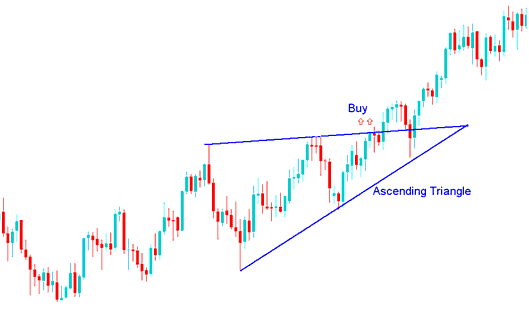

In gold trading, an ascending triangle forms during an uptrend. It points to continued price rises. This pattern signals a trend continuation.

The ascending triangle pattern also is referred to as a rising wedge pattern.

The Rising Triangle pattern signifies an established resistance zone where buying pressure (bulls) repeatedly tests by driving the resistance level upwards: a decisive breakout from this level typically forecasts a continuation of the upward market trajectory.

Overhead resistance temporarily halts price progression upward, while the ascending trendline beneath a rising wedge chart pattern suggests bullish momentum remains active.

When the price goes above the upper line of an ascending pattern, that's a buy signal because the market is breaking out of an ascending triangle pattern.

An ascending triangle pattern, commonly observed during an upward trading trend, signifies a consolidation phase. This formation typically indicates a continuation of the prevailing upward movement.

Trade Rising Triangle Pattern?

The market formed an ascending triangle pattern during its upward trend which led to upside continuation just as is shown on the illustration above. The buy signal is when price clears the upper sloping ascending triangle pattern line and the market continues moving up - upwards trend continuation.

Study More Guides & Courses:

- Placing Buy Limit XAU/USD Orders Below Current Market Prices

- Gold Software MT5 – Using the Toolbars

- Continuation Patterns Related to Gold

- Read Fibonacci Retracement Levels for XAU USD on MetaTrader 5

- How to Handle Risks When Day Trading Gold plus Tips

- Methods for 5 Min Gold Charts

- Chande Trendscore Analysis for Gold Indicators

- Strategies for Trading Gold

- MetaTrader 5 Gator Oscillator – Indicator for MetaTrader 5 Gold platform

- McClellan Histogram: XAUUSD Indicator Analysis