Trading Reversal Patterns & Continuation Setups Patterns

Patterns - Trading Analysis Patterns StrategiesXAUUSD chart patterns show common price moves that repeat. Traders use them often.

Chart patterns are a critical analytic tool, helping traders recognize and study recurring formations for better decision-making.

Chart patterns hold considerable significance in the gold market, particularly because when the market lacks defined directional movement, it is actively forming one of these patterns. Understanding these formations is vital to anticipate the market's subsequent action.

Several Chart patterns spontaneously emerge and recur consistently when price movements are mapped out. These formations are utilized by numerous technical traders to forecast the subsequent market action.

Market participants frequently examine these recognizable Chart patterns to evaluate the underlying supply and demand dynamics that dictate price movement.

These Patterns are classified into Three different categories:

1. Reversal Setups

- Double tops Gold Setups

- Double bottoms Gold Setups

- Head & shoulders Gold Setups

- Reverse head & shoulders Gold Setups

2. Continuation Setups

- Rising triangle Gold Setups

- Falling triangle Gold Setups

- Bull flag/pennant Gold Setups

- Bear flag/pennant Gold Setups

3. Bilateral

- Symmetric triangle - Consolidation Setups

- Rectangle - Range Patterns

Gold reversal patterns confirm a trend flip after a long run up or down. Once set, these shapes warn that the market will turn direction.

Continuation patterns in gold setups prepare the market for more moves in the prior trend. They form during short breaks. Then the market resumes the same direction.

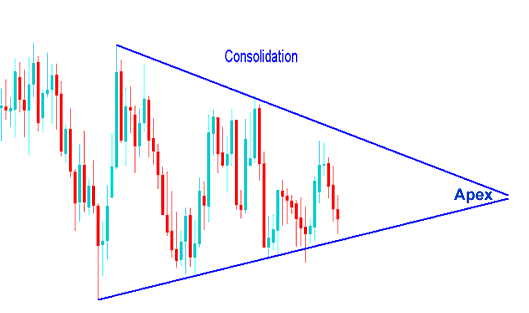

Gold setups with consolidation patterns occur when the market pauses. It rests before picking the next trend direction. These patterns signal the market's effort to choose a trade path.

Technical Chart Analysis of Patterns

There are two distinct types of chart analysis: although these may appear similar, they are different:

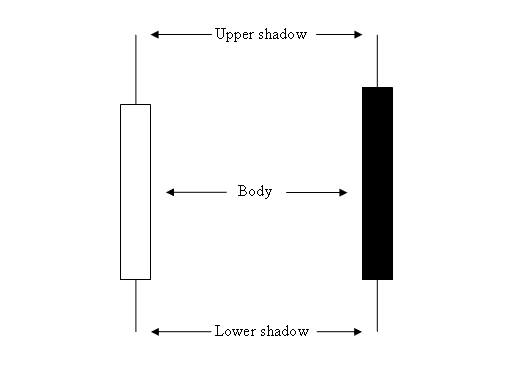

- Japanese Candlesticks Patterns - Study of a single candle - Learning to Understand Japanese Candle-sticks Patterns in Trading

- Chart Patterns - Study of a series of candlesticks formations

(This learn gold tutorial is about the second option above - Patterns)

The different courses for these two types analysis are:

Japanese Candles

XAUUSD Setups Lessons

The accompanying visuals also demonstrate the compositional variances between these two analytical methodologies.

Candles Patterns - Study of a single candle

Chart Patterns - Study of a series of candlesticks

Get More Courses & Guides:

- How Do You Trade XAU/USD Candlestick Patterns?

- Calculated Methods for Determining Optimal Placement and Setting of Stop Losses specifically for XAU/USD Instruments

- Using the Relative Strength Index to Identify Trade Signals

- Gold Indicator: Ultimate Oscillator

- How do you trade gold on the MetaTrader 4 app for iPad?

- What Is an XAU/USD Practice Account? Key Insights Explained

- Identification of Buy and Sell Signals Generated by the DeMarks Range Expansion Trade Indicator