How to Interpret/Analyze Gold Charts Beginners Tutorial

Chart Analysis

There are three types of charts used in Gold: Line Chart, Bar Chart & Candlesticks Chart - how to read gold charts beginner traders Guide.

How to Interpret/Analyze Chart Analysis

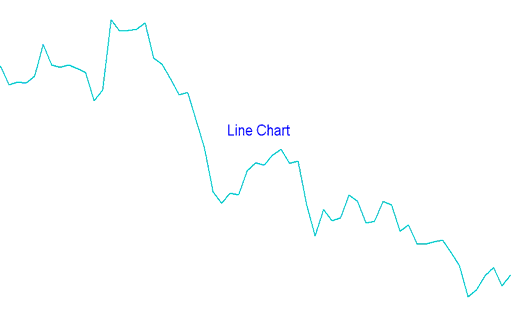

Line Charts - gold line charts draw a continuous line joining closing prices of gold.

Gold Line Charts - How Can I Interpret Gold Charts Beginners Lesson Guide

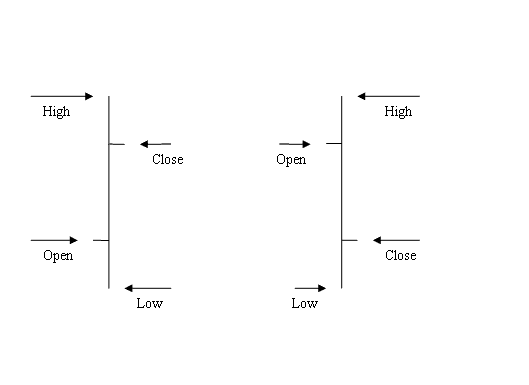

Bar Chart - gold bar charts are displayed as a sequence of O-H-C-L bars. O H C L represents OPEN HIGH LOW and CLOSE. The Opening price is highlighted as a horizontal dash onto the left and the closing price as a horizontal dash onto the right side.

Gold Bar Charts- How to Interpret/Analyze Gold Charts Beginners Lesson Guide

The main disadvantage of bar chart is that it's not visually appealing and identifiable, thence most traders don't use them.

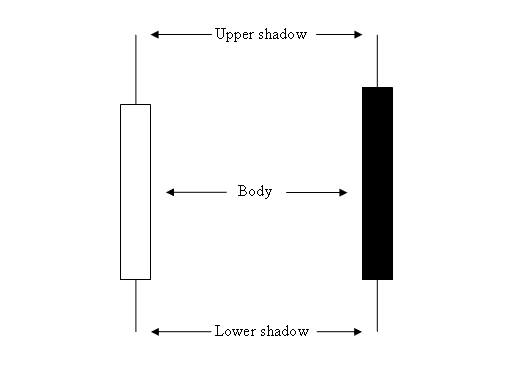

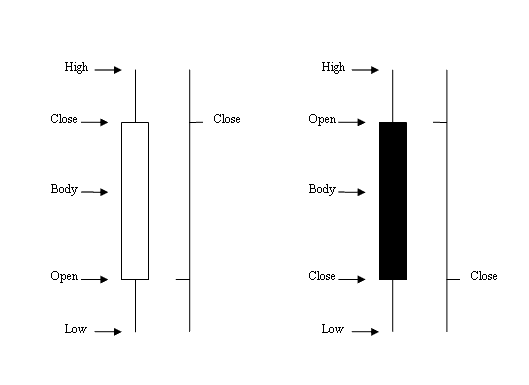

Candles Charts - these candles charts use the same price info as xauusd bar charts (open, high, low, and close). However, they're represented in a more visually identifiable and appealing way that resembles a candlestick with wicks on both ends.

How to Analyze/Interpret Candle Sticks Charts

Rectangle part of the candle is referred to as the body.

The high & low of the candle are referered to as shadows & drawn as poking and protruding lines.

XAU/USD Candlesticks Charts

The colour of candlestick is either blue or red:

- (Blue or Green Color Candlesticks) - Gold Prices moved up

- (Red Color Candlesticks) - Gold Prices moved down

Most trading softwaresplatforms like the MT4 XAU/USD Software, use colours to mark direction of price. Gold Candles colour used are blue or green: when price moves upward, color of candle is blue: when the price moves downwards, color of candle-stick is red.

How to Interpret/Analyze Gold Charts Beginners PDF

When candles charts are used it is very easy to see if the price moved up-ward or down-ward as compared to when the bar charts are used.

The Japanese candles charts techniques also have very many candlesticks formations that are used to trade the Trading Markets. These chart patterns have different analysis interpretation and the most common are:

How to Interpret/Analyze Chart Patterns Beginners PDF

The above candles patterns is what makes the Japanese candles chart patterns popular among traders and it's why this type of technical chart analysis are most commonly used when it comes to analyzing the market. Analysis for these charts setup formations in Gold trade is the same as that one used in stock trading.

Learn More Courses & Lessons:

- What are the Differences between MetaTrader 4 and MT5 XAU USD Platforms?

- XAU/USD Account Bonus No Deposit: $30 No Deposit Bonus XAU USD + 50% Bonus + XAU/USD Rebate Per Lot

- MT5 XAU USD Charts Tutorial Lesson for Beginners

- Japanese Candlesticks Patterns

- Trade with Alligator Strategies

- How Can I Trade MetaTrader 5 Pending Gold Orders in the MetaTrader 5 Software?

- Common XAUUSD Question and Answers About XAUUSD

- Awesome Oscillator Strategies Buy & Sell Trade Signal

- How to Add Buy Stop XAU/USD Order & Sell Stop XAU/USD Order in MT5 Platform Software