Bollinger Bands Strategy

- Functioning of Bollinger Bands

- Analysis of Volatility Using Bollinger Bands

- Understanding Bollinger Band Expansion and Contraction

- How do Bollinger Bands show price action in trends?

- Bollinger Bands: Price Action in Ranging Markets

- Bollinger Bands and Trend Reversal Indicators

- Summary of Bollinger Band Strategy

Bollinger Band Strategy

The Bollinger Band indicator helps to see how much the price changes. The Bollinger Bands indicator is used on the price chart itself.

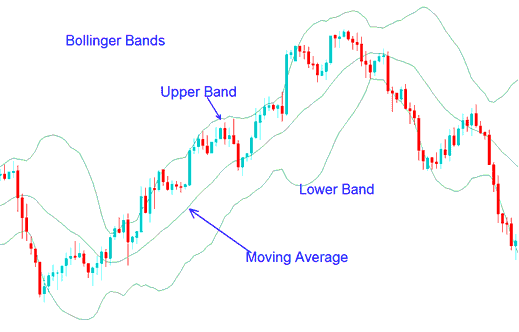

The Bollinger Band indicator comprises three bands: the mid-band (a moving average), an upper band, and a lower band. Prices typically fluctuate within these bands.

The Bollinger Bands indicator creates upper and lower bands around a moving average (MA). The default setting is a 20-SMA, and these bands are calculated using standard deviations from the moving average.

The example of Bollinger Band indicator is illustrated and shown below.

Bollinger Bands Indicator - How to Trade with Bollinger Bands Strategy

Because standard deviation is a measure of price volatility & volatility of the market is dynamic, the trading bollinger bands keep adjusting their width. Higher price volatility means higher standard deviation & the more the bands widen. Low price volatility means the standard deviation is lower and the bollinger bands contract.

The Bollinger Band fx indicator uses price changes to show a lot about how the price moves. The price information from the bollinger bands indicator includes:

- Periods of low price volatility - consolidation phase of the trading market.

- Periods of high price volatility - extended trends, trending markets.

- Support and resistance levels of the price.

- Buy and Sell points of price.

Study More Tutorials & Courses:

- How to Trade a Breakout in a Bullish Gold Pattern

- Identifying the Smallest Possible Trade Volume Acceptable for a Mini XAUUSD Account.

- Explanation of How to Hide Symbols on the MetaTrader 4 Trade Platform

- Understanding Gold Chart Timeframes: How Periodicity Works in Charting Software

- Utilizing the MetaTrader 5 Platform for Gold Trading

- Gold Trading Guides - Complete List of XAU/USD Indicators

- Trading Strategies Focused on Breaking Previous Day Close Levels (XAU USD) and Market Open Scenarios?

- Inserting the Parabolic SAR Indicator for Gold (XAU/USD) Analysis onto a MetaTrader 4 Chart